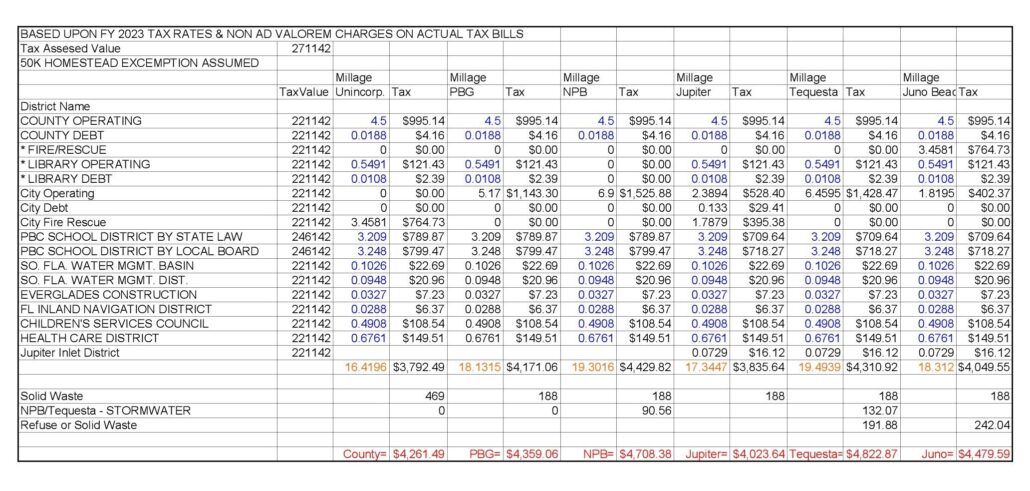

The things I think about. I started off by looking at what the taxes would be if a property is “incorporated” into either Palm Beach Gardens or North Palm Beach. That led me to look at and compare the ACTUAL FY 2023 tax bills from these as well as Juno Beach and Jupiter. SURPRISE! SURPRISE! SURPRISE! Jupiter has the lowest overall tax bills in the area.

- Unincorporated PB County = $4,261.49

- Palm Beach Gardens = $4,359.06

- North Palm Beach = $4,708.38

- Jupiter = $4,023.64

- Juno Beach = $4,479.59

- Tequesta = $4,822.87

The link below is to an excell spreadsheet for a detached house with a 50k Homestead Exemption…