OK, the new Flood Maps are out and effective and I had the ‘opportunity’ recently to learn much more than I ever thought I would want to about flood insurance. First, for those of us in Palm Beach County, start here (https://maps.co.palm-beach.fl.us/cwgis/?app=floodzones) to determine what flood zone you MIGHT be in. Flood insurance is based on your building, specifically the lowest floor elevation of the living space, NOT your land. The problem is that most computer programs, like the one used by the County, can only ‘see’ where a flood zone contour crosses your property line. If the building is within the aqua colored dotted area or the aqua colored line around this area crosses through your building then at first look your ARE in the Special Flood Hazard Areas (SFHAs) – Zones: A, AE, AH, AO.

If the contour passes close to your building or you think the map is wrong or your lender/insurer refuses to apply the logic outlined in the FEMA Flood Insurance Manual (FIM) on classifying the building (NOT THE LAND) you can apply to FEMA for a Letter of Map Change and ask for a Letter of Map Amendment. FEMA will tell you what the official determination is. The process is easy and it’s free if your house was built pre FIRM.

CLICK HERE for my post on how to determine if your house is pre or post FIRM

IF you are in a SFHA, or the line goes through your building or touches it or basically IF YOU ARE GETTING ANYTHING OTHER THAN A ‘PREFERRED RATE’ FLOOD POLICY then you should hire a Land Surveyor to prepare an Elevation Certificate and it all has to do with something called Freeboard. Freeboard is the distance between the Base Flood Elevation and your finished floor elevation. In pre FIRM construction all that matters to get the best rates is for the Lowest Adjacent Grade to the building to be higher than the Base Flood Elevation or BFE. In my area the BFE is shown on the maps as say ‘BFE 6′, which is to say that the Base Flood Elevation has been determined to be 6’ above the 1988 datum or baseline. I am in Zone X but the zone AE (BFE 6) goes in front of my house. Let’s look at this and the difference in insurance costs for a Zone X and a Zone AE. Remember Zone AE is in the SFHA.

FOR POST-FIRM CONSTRUCTION

If you have an elevation certificate (weather your house was pre or post FIRM construction) then you should be able to use the ‘Post FIRM’ Zone AE insurance rates found in the FIM which account for freeboard and are significantly lower. For comparison. A pre FIRM (pre 1974) building in Zone B,C,X,AR and A99 pays $344 for a preferred risk policy as a flat rate for 250k of building coverage. A pre FIRM building in Zone AE, where the AE zone contour goes through your house, is $2,304. BUT, if you have an elevation certificate and the finished floor inside your house is just 1′ above the 6′ elevation (BFE) then you pay $769 for 250k of coverage. If your interior floor is 2′ above the 6′ Base Flood Elevation defining this AE Zone then you pay $453 for 250k of building coverage. I paid $250 for an elevation certificate from Legacy Surveying (Office@LegacyPSM.com) in Tequesta.

NOTE FOR PRE-FIRM CONSTRUCTIONhttps://MAIL TO: office@legacypsm.com

If you in a pre firm constructed house then you may use the method outlined above OR you may apply for a Letter of Map Amendment with FEMA. You will need an Elevation Certificate F-053_EC_May2017_RE_rev an Elevation Form MT-1 Form 2 – Elevation Information Form to do this. If you are in a pre FIRM constructed house then basically you don’t need much freeboard to get the preferred risk policy rates. All that is required is that the Lowest Adjacent Grade to your structure be higher than the Base Flood Elevation. So in my neighborhood most houses are pre FIRM and the Base Flood Elevation is 6′ measured from the 1988 datum and all the houses are the standard slab on grade. So if the Lowest Adjacent Grade to the house is greater than 6′ then you should apply for a Letter of Map Amendment from FEMA. This sounds like a big deal but really it’s not. Here’s a little trick I found. In my rush for fame and glory I applied through the on line system at the FEMA web site. They came back and said I needed an Elevation Certificate. NO reasoning with the bureaucrats on this so I got one. BUT IF I HAD USED THERE PAPER FORM THERE IS PLACE ON IT WHERE A SURVEYOR CAN CERTIFY THE LOWEST ADJACENT GRADE IS ABOVE THE BASE FLOOD ELEVATION. That’s it. No more documentation should be required.

I APPLIED FOR A LETTER OF MAP REVISION AND I GOT ONE. CLICK HERE TO READ ALL ABOUT IT.

An Elevation Certificate is well worth it.

Special Flood Hazard Area (SFHA). An area having special flood, mudflow or flood-related erosion hazards and shown on a Flood Hazard Boundary Map (FHBM) or a Flood Insurance Rate Map (FIRM) Zone A, AO, A1-A30, AE, A99, AH, AR, AR/A, AR/AE, AR/AH, AR/AO, AR/A1-A30, V1-V30, VE or V. For the purpose of determining Community Rating System (CRS) premium discounts, all AR and A99 zones are treated as non-SFHAs.

Shaded Zone X is a moderate risk areas within the 0.2-percent-annual-chance floodplain, areas of 1-percent-annual-chance flooding where average depths are less than 1 foot, areas of 1-percent-annual-chance flooding where the contributing drainage area is less than 1 square mile, and areas protected from the 1-percent-annual-chance flood by a levee. No BFEs or base flood depths are shown within these zones. (Zone X (shaded) is used on new and revised maps in place of Zone B.)

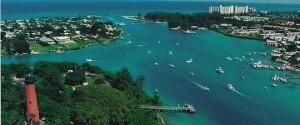

Why we live near the water…