What happens under the Far Bar As-Is (Rev 06/19) Contract if the Buyer can not obtain flood insurance?

PLEASE GO TO MY UPDATED BLOG POST FOR THE FAR BAR AS IS REVISED IN NOVEMBER 2021.

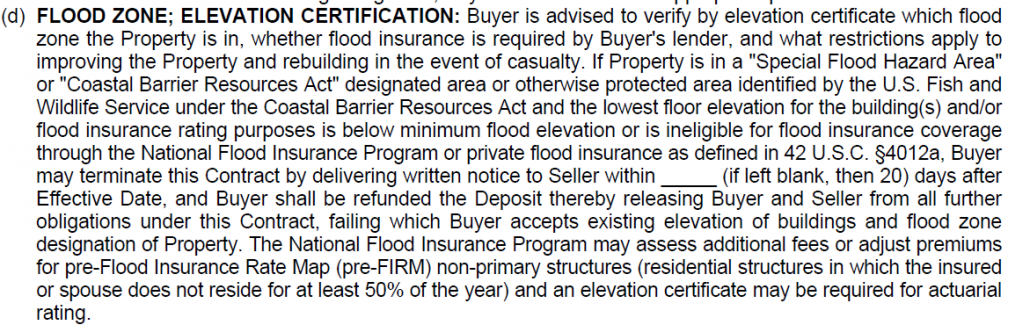

The applicable section of the Contract is:

First question: Is the Property located in a Special Flood Hazard Area (SFHA)? If it is NOT in an SFHA then this paragraph is not applicable. If it is in an SFHA (such as Zone AE or V) then the next questions is: “… the lowest floor elevation for the building(s) and/or flood insurance rating purposes is below minimum flood elevation or is ineligible for flood insurance coverage through the National Flood Insurance Program or private flood insurance as defined in 42 U.S.C. §4012a, Buyer may terminate this Contract…”

Honestly, this needs to be reworded on the first part “…and the lowest floor elevation for the building(s) and/or flood insurance rating purposes is below minimum flood elevation…” Is this to be interpreted that if the lowest floor elevation is below the Base Flood Elevation (BFE) set for the SFHA that the Buyer may withdraw? I’m looking into this.

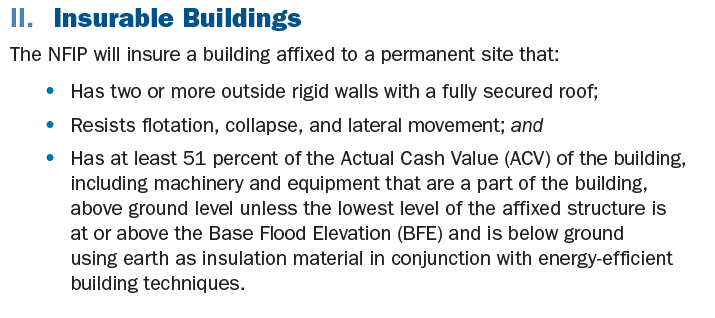

The second part is straight forward. Is the finished floor elevation so low that the Property is in-eligible for coverage? This question as it turns out is specifically covered by the NFIP Flood Insurance Manual which states…

So basically all fixed houses (not a mobile home) which are built above grade (above the adjacent dirt, NOT the BFE) OR one which is NOT built above grade where the lowest level is above the Base Flood Elevation. In short, everyone CAN get flood insurance it’s just a question of cost. At least right now.

The interesting, and perplexing point here is that IF the house is shown inside the SFHA. Or if the SFHA even touches the property then the property owner may apply for a LOMR or Letter of Map Revision. I have done this. The criteria used for this is that the LAG or Lowest Adjacent Grade (the dirt around the house) must be higher than the Base Flood Elevation. “Federal regulations require the lowest ground touching the structure, or Lowest Adjacent Grade (LAG) elevation, to be at or above the Base Flood Elevation (BFE).” Looking at the rate tables the big “jump” in the rate per dollar of insured value (the cost) of flood insurance comes when the finished floor is less than 1′ above the Base Flood Elevation.

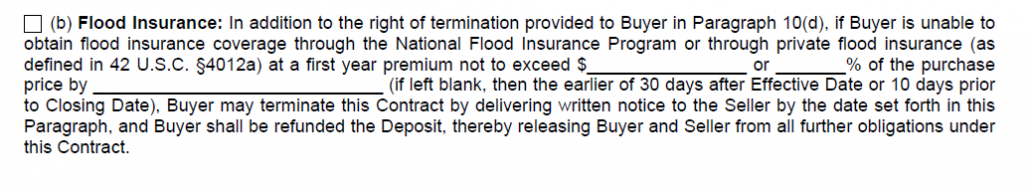

What I would recommend doing is IF a home is located in an area where flood insurance is now required then I would use the Homeowners/Flood Insurance addendum to the Far/Bar contract which add this:

Note that the areas which are located inside a Coastal Barrier Resource Act area are basically ALL existing parks like MacArthur, Carlin, Blowing Rocks and the Hobe Sound National Wildlife Sanctuary. So basically, no place that anyone lives around here.