I did a post on this a while back and with Risk Rating 2.0 being implemented and the changes made to the FAR BAR AS-IS in 2021 I thought I would revisit it.

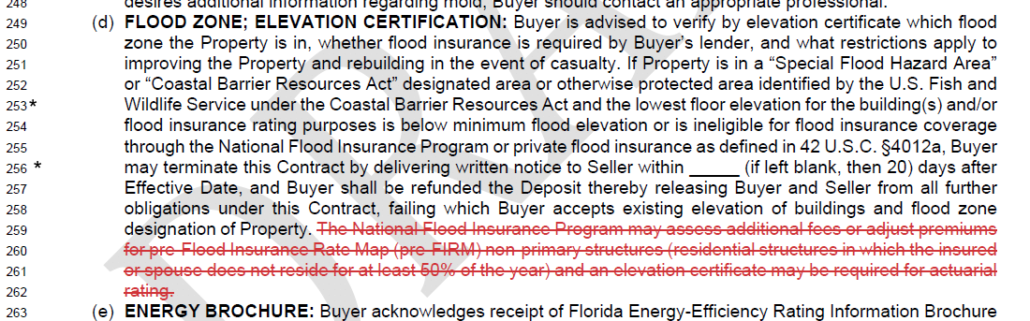

First, this is one of the updated sections which covers this and probably the often concerned…

The struck language is (was) just a notice.

First question: Is the Property located in a Special Flood Hazard Area (SFHA) or…? If it is NOT in an SFHA then this paragraph is not applicable. This is a problem as one could be in an area where only Citizens will write a wind policy but it’s not in a SFHA. Doesn’t sound to bad. But with Risk rating 2.0 this could still be several thousand in flood premiums.

If it is in an SFHA (such as Zone AE or V) then the next questions is: “the lowest floor elevation for the building(s) and/or flood insurance rating purposes is below minimum flood elevation OR (caps added) is ineligible for flood insurance coverage through the National Flood Insurance Program OR (caps added) private flood insurance as defined in 42 U.S.C. 4012, Buyer may terminate this Contract…within 20 (assuming this line is left blank) days from the effective date”.

Honestly, this needs to be reworded. First of all, the Elevation Certificate (EC) is typically ordered with the survey and this is typically not ordered until a week or so before Closing. I doubt this EC happens within the 20 days after the Effective Date window. IF YOU HAVE CONCERNS ABOUT FLOODING, FLOOD INSURANCE, OR THE , THEN GET THIS DONE ASAP. The first part ‘and the lowest floor elevation for the building(s) and/or flood insurance rating purposes is below minimum flood elevation…’ I’m no lawyer but I would question if this “minimum flood elevation” is to be interpreted that if the lowest floor elevation is below the Base Flood Elevation (BFE) set for the SFHA that the Buyer may withdraw? Or, is it that the minimum flood elevation is the lass than the Base Flood Elevation plus 1′ that the Buyer may withdraw. Base Flood Elevation plus 1′ are what new, or substantially renovated, properties must be built to.

The second part looks to be straight forward. Is the Property in-eligible for flood insurance coverage? This question as it turns out is NO LONGER so clear in the new NFIP Flood Insurance Manual . The FAQ document for this states…

“When Risk Rating 2.0: Equity in Action is implemented, will repetitive loss properties continue to be covered with an NFIP policy?

Under Risk Rating 2.0: Equity in Action, Repetitive Loss and Severe Repetitive Loss properties will continue to be eligible for coverage provided by the National Flood Insurance Program. See Flood Insurance Manual Section 3. II. C. 8. b.” So even Repetitive Loos properties CAN get a flood policy.

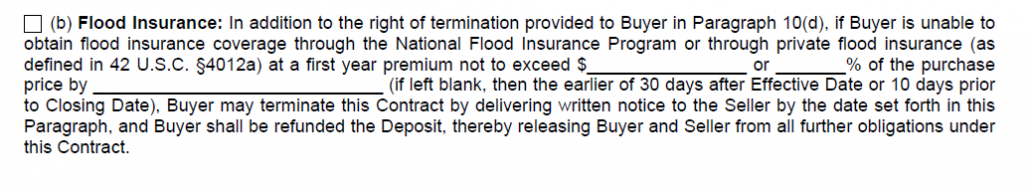

What I would recommend doing is IF a home is located in an area where flood insurance is required by the Lender (SFHA) or if it is an area that is only covered by Citizens for wind (as Citizens now requires flood insurance) then I would use the Homeowners/Flood Insurance addendum to the Far/Bar contract which add this:

So you can get a policy but it sets a $$ threshold.

Note that the areas which are located inside a Coastal