There are just 2 types of waterfront property here in Florida. The property either abuts “navigable waters” and is said to enjoy “riparian rights”, OR the property abuts “over flowed lands” where the rights are whatever the owner of that land below the water has granted the abuting lots.

Riparian rights are those granted to properties which abuts “navigable waters”. The land below these DEFINED navigable waters is owned by the state of Florida and is referred to as “sovereign submerged lands”. If the property does NOT abut navigable waters then that property abuts “over flowed” lands where the land is owned by someone other than the state. This is a HUGE difference because remember title insurance does NOT cover ANY waterfront property rights.

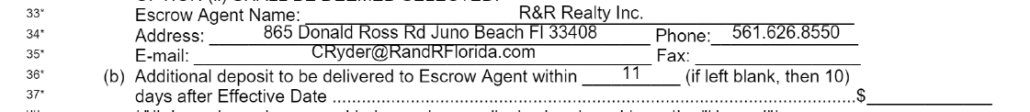

If you’re reading this because your agent does noy know then it’s time for a new agent. Call me, Chris Ryder at 561.818.3858.

So, how do you tell which one it is? There are a few ways. The first and easiest way it to look at a recent DEP permit for a dock. One may search by address at this DEP Site. Or, if it is a drainage canal the you must look at the South Florida Water Management portal, which includes Martin County. First, if it’s on the SFWMD site then they only control certain man made drainage canals so odds are that it’s over flowed lands. If you find a recent dock permit on the DEP site then look for the verbiage of : “The activity appears to be located on sovereign submerged lands owned by the Board of Trustees.” IF it has this language then good news, you’re looking at a property that enjoys riparian rights. They do this because there are different laws and rules for dock construction depending on what type of land is below that water.

If you can not find a dock permit then it’s a bit more in depth. First, use your common sense. Riparian lands are those which were navigable when Florida entered the union in 1845. So, for instance the St. Lucie river was in fact a river in 1845. Also, it’s named body of water, which is another “test”.

One can look at the Board of Trustees of the Internal Improvement Trust Find website. Look up the parcel and look to see if the irregular line is adjacent to this property. This is a good indicator.

One could also look at what is called the Reyes Survey in the LABINS website . This was a land survey paid for by the state c1859 where the state sent out a surveyor to locate the mean high water line of what was navigable waterways. The lands landward of this line could be sold by the state. The lands waterward of it could also be BUT ONLY under a very strict set of circumstances. This all has to do with something called the public trust doctrine.

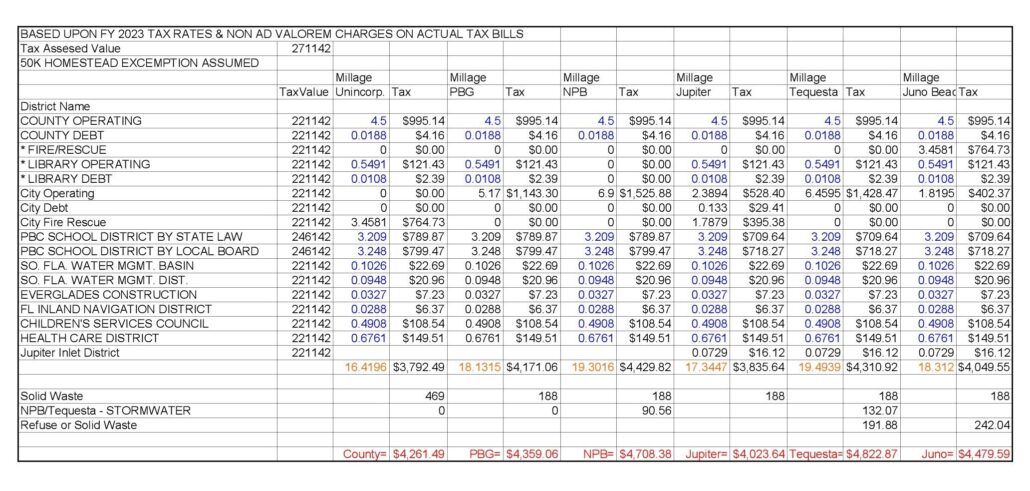

Anyway, fast forward as these large parcels of upland “government lots” were sold off by the state and later subdivided by the owner via a recorded plat. Let’s look at one of these plats for one for my listing at 1918 SW Mooring Drive in the Gull Harbor sudivision in Palm City, in unincorporated Martin County.

Look at Lot 40 on this plat which is 1918 SW Mooring and note that the property lines which intersect the water are given as +/- dimensions. The +/- dimensions are used by the surveyor as the property lines intersect the riparian line, sometimes called the meander line. And they are +/- because this line, the ripiarian line, is said to be “ambulatory”. It can move, so long as that movement is slow, imperceptable, and caused by nature. By contrast, look at the property lines for lot 38. One property line is +/-, and the other is NOT. It’s an exact dimension as that property line does NOT intersect the historic meander line. That property has some riparian waterfront on the east side, while lot 37 has no +/- dimensions and thus NONE. So what?

Well, the first question to ask is IF the state does NOT own the land below that water then who does? The folks who live on what is erroneously called the Earman River in North Palm Beach starting getting letters a few years back from the entity which claims to own the land below their docks. And if you want to keep your dock then get your checkbook out. How about the right to go over that submerged lands to get to the navigable waters? How about who dredges that canal, how often, to what depth, and how it’s paid for? And remember, waterfront property rights are NOT covered by title insurance.

However, if it is riparian lands then by FS…

253.141 Riparian rights defined; certain submerged bottoms subject to private ownership.—

(1) Riparian rights are those incident to land bordering upon navigable waters. They are rights of ingress, egress, boating, bathing, and fishing and such others as may be or have been defined by law. Such rights are not of a proprietary nature. They are rights inuring to the owner of the riparian land but are not owned by him or her. They are appurtenant to and are inseparable from the riparian land. The land to which the owner holds title must extend to the ordinary high watermark of the navigable water in order that riparian rights may attach. Conveyance of title to or lease of the riparian land entitles the grantee to the riparian rights running therewith whether or not mentioned in the deed or lease of the upland.

(2) Navigable waters in this state shall not be held to extend to any permanent or transient waters in the form of so-called lakes, ponds, swamps or overflowed lands, lying over and upon areas which have heretofore been conveyed to private individuals by the United States or by the state without reservation of public rights in and to said waters.

(3) The submerged lands of any nonmeandered lake shall be deemed subject to private ownership where the Board of Trustees of the Internal Improvement Trust Fund of Florida conveyed the same more than 50 years ago without any deductions for water and without any reservation for public use and when taxes have been levied and collected on said submerged lands since conveyance by the state.

(4) Where private ownership of submerged bottoms outward from the shore has originated in a Spanish or other land grant approved by the Congress specifically describing an area in which was included navigable water, or by patent out of the United States prior to the date on which Florida became a state likewise containing a description including navigable water, or upon a valid conveyance out of the state, the submerged land included in such grant, patent, or conveyance shall be subject to taxes lawfully imposed.

I will also note that the recorded plat noted above dedicates to the public the roads shown on it BUT there is NO mention of the canal. Now there may be something recorded in the public record after the plat was recorded that I am unaware of.

You want to be as sure as possble. if you’re buying a property that is waterfront then during the due dilligence period have a title report done by your lawyer on the subject AND one for the land below the water adjacent to it.