Part 3 – CBS or wood frame?

Now we know if the house was constructed under the Florida Building Code 2001 or later version as discussed in Part 2 is in the best category for wind storm insurance rating and now under FEMA Risk Rating 2.0 CBS homes get a better rating for flood insurance as well.

So let’s look at the basic construction of the house, CBS (Concrete Block and Stucco) or Frame (wood frame)? I did this post on the various acronyms used by the property appraiser for basic wall construction.

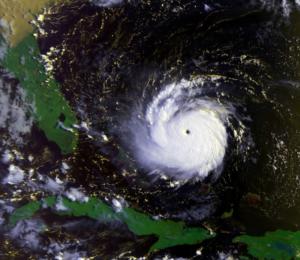

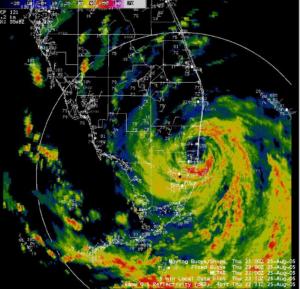

This questions is as “old as the hills.” To be clear, there is wood framing in most houses in the roof trusses and the plywood or OSB roof sheathing. Wood framing is perfectly capable of resisting the loads of a hurricane BUT concrete block is a MUCH tougher material and much less prone to building or maintenance flaws. What do I mean? Well, wood framing is reliant on the person framing the house using enough nails and metal hurricane straps to hold everything together which may or may not be true. Also, wood degrades due to insects or lack of maintenance allowing water in and wood rot to occur. For these reasons wood framed houses tend (TEND) to not do as well in a hurricane as CBS houses. And thus, insurance rates are higher for wood framed house.

I myself choose to live in a CBS house with plaster interior walls in North Palm Beach.

Many 2 story houses have CBS first floor walls with a wood framed second floor and second floor walls. How about these? This configuration does protect the wood wall framing from subterranean termites as well as plants, ants and the like that tend to be at ground level. This is better than an all wood framed. The better constructed newer multi story homes have CBS walls right up to the roof trusses in communities like Botanica and these have a concrete second floor slab as well. For flood insurance only the first floor need be CBS to get the best rate.

How about those wood roof components? In our area most of the roof structure is made of wood trusses fabricated off site in a somewhat controlled environment. Post hurricane investigations have shown that truss failure is generally not a problem BUT soffit failure is and this can lead to the plywood failing if the wind gets under it due to a soffit failure.

And the plywood (or OSB) sheathing over the trusses? If the roof has been replaced under the 2002 (or later) FBC then this has been re-nailed so long as there was a permit pulled for the work which is true for most roofs. People tend not to re-roof a house themselves. Again, if there are enough nails then generally the plywood itself does not fail but it can if the roof has been leaking and the water has degraded the plywood.

How about the roof straps? These are the metal straps that connect the roof framing (truss) to the wall. THESE ARE CRITICAL, can be problematic and should be inspected. First, there’s some ‘funny math’ as to IF the straps HAVE to be re-nailed when the roof is replaced. So just because the roof is replaced it does NOT equate to the straps being re-nailed. Second, they’re metal so they CAN rust, but honestly rarely do as life expectancy of 35+ years. In a CBS house these are set into the concrete at the top of the wall and if the truss lay out changed then they may not have been in the correct location. Check this. Finally, although the straps used in the 70’s for instance were very thick and wrapped over the top of the truss (which is great) they had just two nails in them. These (the number of nails) need to be inspected and yes it is possible to add nails to the existing straps. Interested in how how this will save you? Read HERE,

Next up in this series we will discuss the roof itself in part 4 of the series