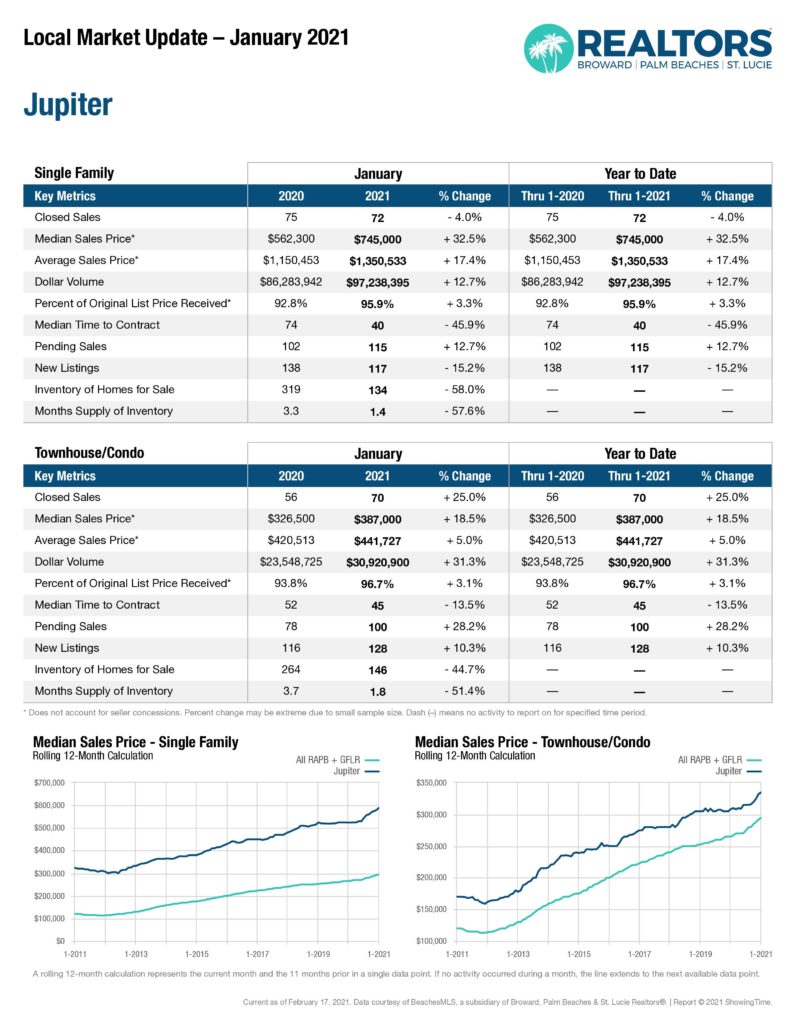

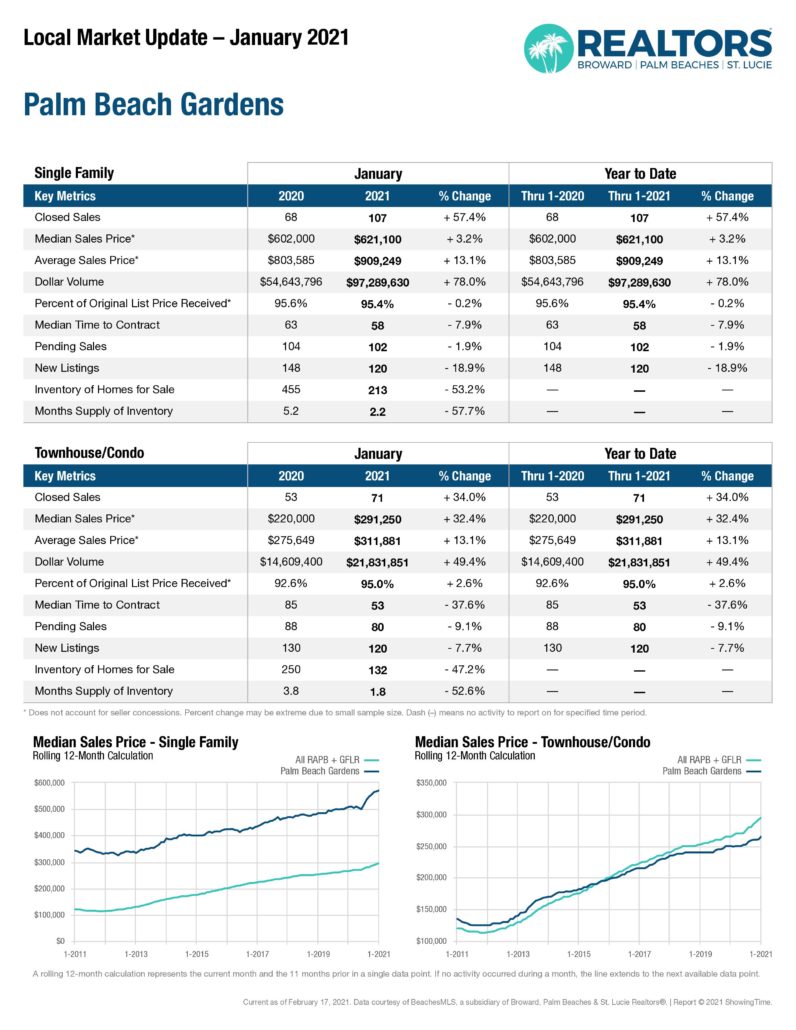

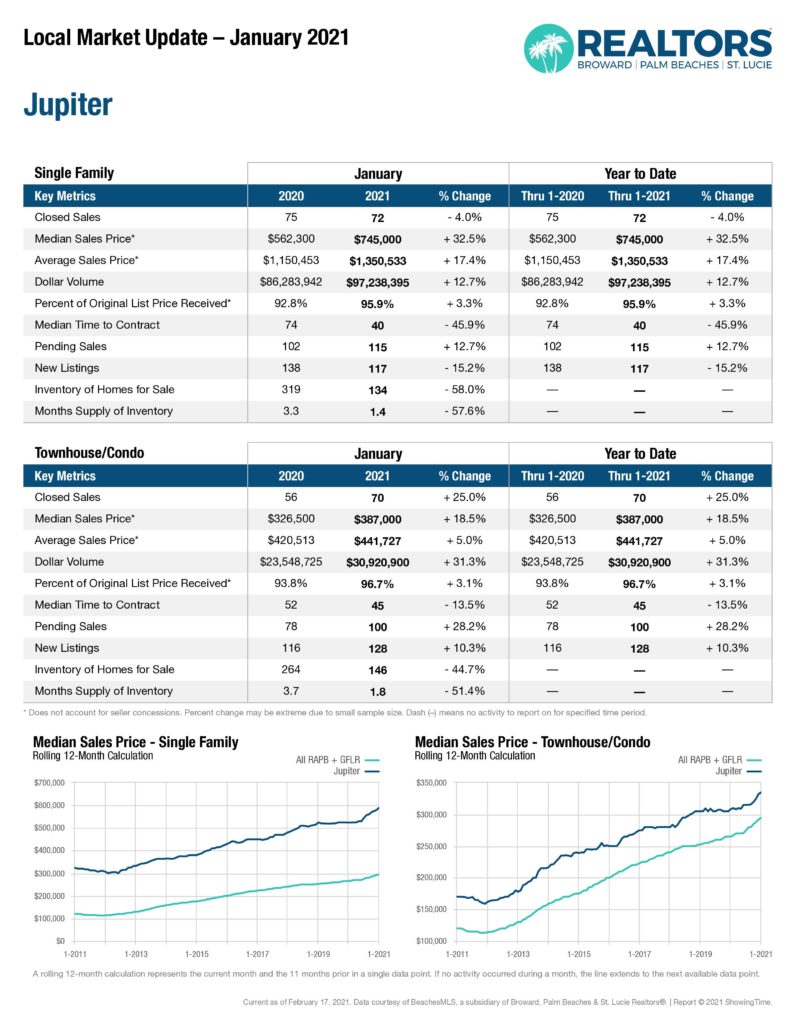

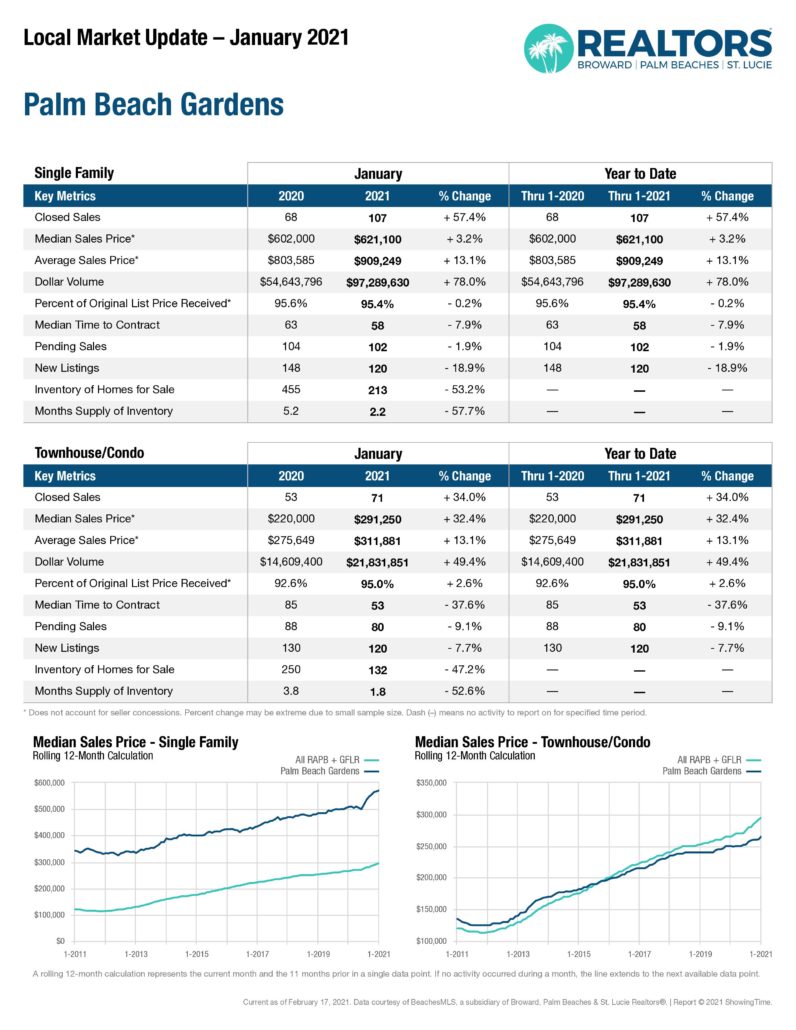

Nothing new to report here. Housing sales remain VERY strong in the Jupiter and palm Beach Gardens area with just a 1.4 month supply of Single Family homes inventory in Jupiter and 2.2 in Palm Beach Gardens.

R&R Realty - Jupiter Real Estate

Find Jupiter-Palm Beach Gardens-Juno Beach-Singer Island-Jupiter Island property.

Read my articles for great information on Buying a home in Jupiter Florida.

by Chris Ryder

Nothing new to report here. Housing sales remain VERY strong in the Jupiter and palm Beach Gardens area with just a 1.4 month supply of Single Family homes inventory in Jupiter and 2.2 in Palm Beach Gardens.

by Chris Ryder

The NFIP is a wreck and the insurance agents have convinced the politicians to change the rating system entirely. Enter Risk Rating 2.0. Gone are the days of loking at a map for your zone and doing some basic math to get to a bill. Now it’s all behind the curtain of “propritary information”.

What they are developing is a rating system using data from Core Logic (IMO not a great company) and some sort of black magic math system to rate properties. No idea if they will continue to use elevation certificates or published flood maps or underwriting manuals right now. Use this link to look up how your property will be rated in the new system.

by Chris Ryder

I got thinking last night about IF a pole barn on a property in the western residential communities of Palm Beach would qualify for an agricultural exemption to the building code. This brochure from the county talks about when a permit is, is not, or may not be required. In this they note the agricultural exemption found in the Florida Statute…

And they discuss it at length in PZB-PPM-MD-RI-002

The intent of this section of the statute goes back many years. Florida is a huge agricultural state and as such the legislature, and by extension the building codes, have historically recognized that a farmer should not need a permit to build say a chicken coop (poultry barn) on his farm. It may be greater than 6 foot by 6 foot but its still just a chicken coop. The allowed non residential structures are now broader in definition that this but this is the basics of it. However, if there is power, water or sewer run to the structure then that would require a permit (even if the building did not) and the improvements must comply with local zoning ordinance for setbacks and the like. For the exemption to the building code to be POSSIBLE though the property must be zoned for and have an agricultural use and tax exemption legally in place and this is where the question comes in for communities like Caloosa, Jupiter Farms and Palm Beach Country Estates. All of these have an AR or Agricultural Residential zoning so agricultural uses are allowed BUT it must be actually used for a “bona fide agricultural purposes” and “good faith commercial agricultural use of the land.” The statute requires that the use must comply with the definition found in FS 193.461 which is the section that defines these uses so as to qualify for the agricultural exemption for a reduction in the taxable value of the property. The typical equestrian use does NOT qualify for the agricultural exception for real estate tax purposes but if there is boarding or breeding horses or another agricultural use on the property then this MAY qualify but it must be a commercial use complete with leases for boarding multiple horses, or a registered stud for breeding. And one must have all the required health and occupational licenses. So, the first check should be of PAPA and if the property has a AG tax exemption on the taxable value. If it does then great as P&Z will take this to be that it will qualify for the exemption. If not then one must prove that there is an on going legal agricultural business at the property that qualifies. BUT be ready to be turned down. The norm for most regular folks reading this is that one will need a building permit for a pole barn or even a stable in the absence of an agricultural tax exemption.

by Chris Ryder

If your association is a condominium, then a $10,000 fine is prohibited by 718.303 Florida statue which limits the maximum fine that the association can levy to $100 per violation and up to $1,000 in the aggregate for a continuing violation.

If your association is an HOA, then 720.305 Florida Statute provides that, “a fine may not exceed $1,000 in the aggregate unless otherwise provided in the governing documents.”

by Chris Ryder

Update on Beach Renourishment Project – February 10th

| BEACH RENOURISHMENT PROJECT UPDATE – FEBRUARY 10TH Please be advised that the Palm Beach County’s beach renourishment project continues working south of the Juno Beach Pier and will soon be proceeding along the shore east of the many condominiums and homes adjacent to our beach. As the heavy equipment moves south, the County and Town urge you to avoid the areas where construction activities are underway. Temporary fencing will be installed to restrict public access to locations where heavy equipment operates. We ask beachgoers and observers to avoid these active construction locations for the safety of all. Work will continue around the clock to complete this important project in the shortest possible time and prior to the start of the turtle nesting season. While the project continues on schedule and pumping operations are expected to be completed by February 20th, additional work including the removal of pipe and beach tilling will follow. |

by Chris Ryder

6363 SE Williamsburg Drive 204 Hobe Sound, FL 33455 In Williamsburg at Heritage Ridge

Tucked into the back corner of the community is this lovely END UNIT 2/2 CBS condo with FULL hurricane shutters. The oversized balcony is open on 2 sides offering terrific air flow and views of the 6th hole T off yet very private. All new top of the line kitchen appliances including FULL size LG stacked front load washer and dryer, disposal and matching Frigidaire Gallery refrigerator, dish washer, stove and microwave oven. Unit includes a large storage closet just outside the door and 1 covered parking space. The roof was replaced by the association in 2018. Not 55 plus and one pet under 20 Lbs is OK. Seasonal (only) rental is OK for 90-120 day stays. The Community offers 2 heated pools, hot tub and tennis courts. POA has golf, pool, tennis and restaurant. Quiet and convenient Hobe Sound.

Heritage Ridge Golf Club memberships are available, but not required, to play golf on the Tom Fazio designed course or to have drinks and dine at the club house. Enkoy the large community pool and tennis courts. Just 10 minutes from the shopping and waterfront restaurants in Manatee Pocket and 12 minutes from the best beach in the area, the Hobe Sound Beach on Jupiter Island in the Hobe Sound National Wildlife Sanctuary. Enjoy the convenient and quiet life style this is Hobe Sound.

By Chris Ryder

17892 Mellen Lane Jupiter, FL 33478 in Jupiter Farms Welcome to your dream home in the highly sought-after Jupiter Farms! This stunning 3-bedroom, 2-bathroom pool home offers a perfect blend of modern updates, timeless charm, and outdoor living at its finest. Boasting a brand-new 2023 roof, new A/C, and numerous upgrades throughout, this home is move-in ready and waiting for you to call it home. […]

By Chris Ryder

703 Voyager Lane North Palm Beach, FL 33410 in Prosperity Harbor… Welcome to Prosperity Harbor North – a gated, waterfront community offering Day Docks with access to the ICW & the Atlantic Ocean! A true boater’s paradise! Live the dream in a Pulte-built 2-story home w/primary suite & updated bathroom on the 1st level & 3 guest BRs upstairs, all with balconies. Flexible living space […]

By Chris Ryder

How many horses can one have on a residential property in Palm Beach County? One would think that this is an easy answer to get but it’s not. First, I am thinking residentially zoned property in places like Jupiter Farms. So outside the municipality of places like Jupiter or Palm Beach Gardens and no Home Owners Association such as in places like Caloosa. Note that […]