To start off with, please be smart and use the EAC-1 addendum prepared by the Florida Association of Realtors…

This is pretty self explanatory. Enter your offer price from the base Contract, then use this form to indicate what each increase is (say 1k to 5k) as the “Escalation Amount” above a competing offer, up to the maximum you are will to spend, the “Maximum Purchase Price” entered. If you’re offering cash then send along proof of funds up to the “Maximum Purchase Price”. IF YOU ARE OBTAINING A LOAN then be careful and ask your lender what will happen if the property fails to appraise, will the loan product allow for either option (a) or (b) to be utilized?

Source: Destination Escalation Clause?

As escalation clauses become more popular during this hot seller

Why does the Condominium or Home Owners Association need to approve the sale of Property?

This question came up recently as we (Realtors) all just seem to assume that if a house in a Home Owners Association or a Condominium Association that the Buyer MUST submit an application to be approved that association. This may or may not be the case.

So, if (IF) the recorded documents (or the non recorded rules IF the recorded documents are silent on the question of approval of a sale or lease or allow for the association to adopt rules) say that the association MUST approve a sale (or Lease) then this will be noted on the title insurance commitment but often times this is not received until well after the condo or HOA rider would require a Buyer to make application. IMHO it’s best to make an application. If the certificate of approval is not required by the Title Agent at Closing then no big deal.

What’s interesting is that places like Evergrene in Palm Beach Gardens still have not (as far as I can see) updated their recorded documents nor rules of the association to require sales and leases to be approved by the master association NOR for the condominium units at the Mansions at Evergrene.

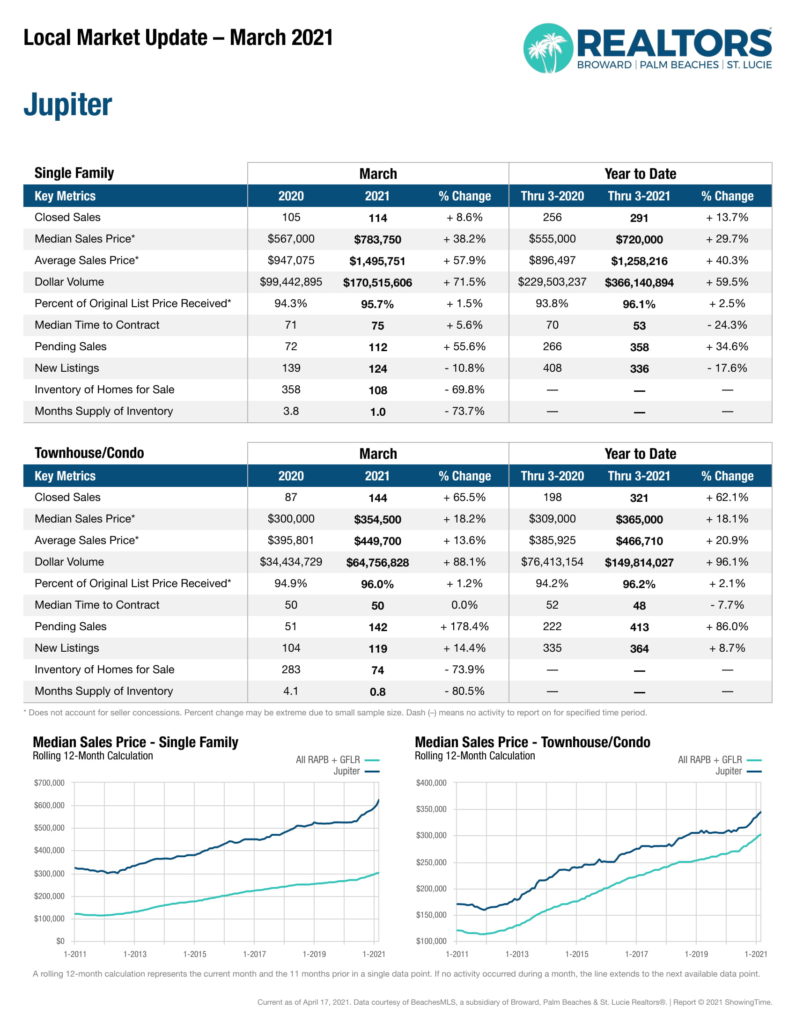

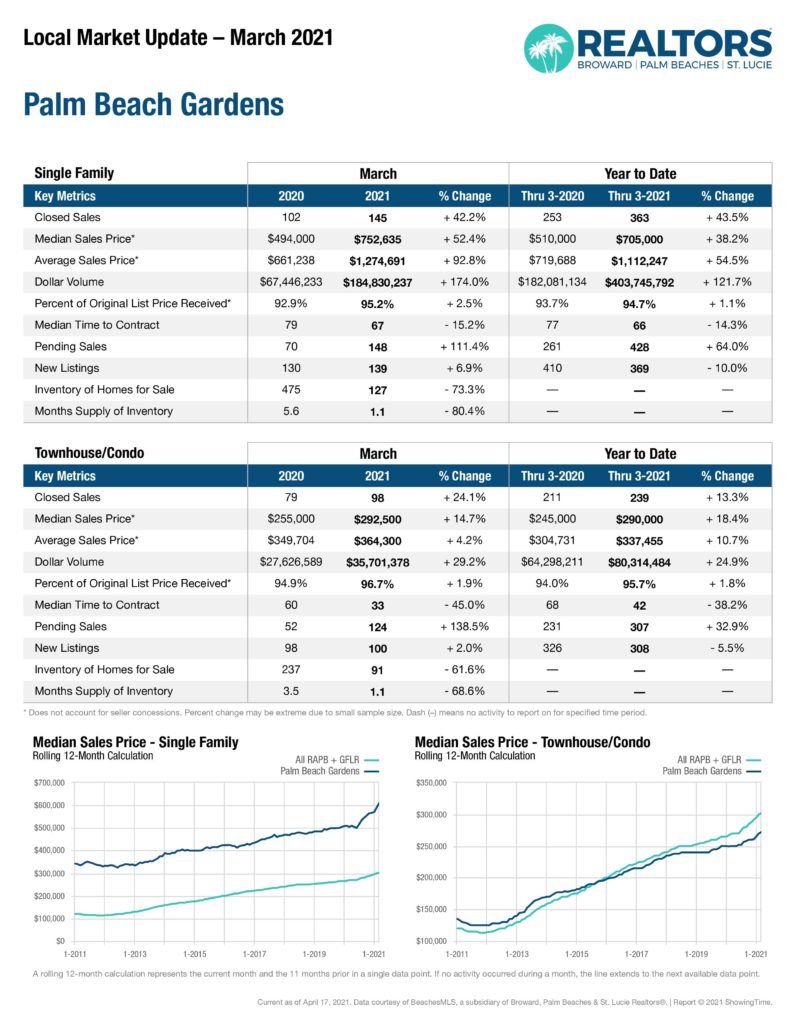

Jupiter and Palm Beach Gardens Housing sales for March 2021

The sales numbers for March were just released by the Realtors Association and once again, no big surprise. The market is going up at a rapid rate and disproportionately so in the high end communities. Places like Admiral’s Cove in Jupiter and Old Palm in Palm Beach Gardens which historically had a a low “velocity” of sales have seen years of inventory absorbed in just a few months.

Does the Seller need to disclose and/or remedy violations of a Home Owners Association?

This came up recently. The Evergrene HOA in Palm Beach Gardens as soo as a Property goes under contract they send out a representative to inspect the Property. If they find any violations then they send out a notice to the Owner AND they may even note it on the estoppel letter requested from the Closing Agent. Now what?

Noting the language of the base Far Bar As-Is Contract:

SELLER DISCLOSURE: Seller knows of no facts materially affecting the value of the Real Property which are not readily observable and which have not been disclosed to Buyer. Except as provided for in the preceding sentence, Seller extends and intends no warranty and makes no representation of any type, either express or implied, as to the physical condition or history of the Property. Except as otherwise disclosed in writing Seller has received no written or verbal notice from any governmental entity or agency as to a currently uncorrected building, environmental or safety code violation.

Unless Buyer exercises the right to terminate granted herein, Buyer accepts the physical condition of the Property and any violation of governmental, building, environmental, and safety codes, restrictions, or requirements, but subject to Seller’s continuing AS IS Maintenance Requirement, and Buyer shall be responsible for any and all repairs and improvements required by Buyer’s lender.

PROPERTY MAINTENANCE: Except for ordinary wear and tear and Casualty Loss, Seller shall maintain the Property, including, but not limited to, lawn, shrubbery, and pool, in the condition existing as of Effective Date (“AS IS Maintenance Requirement”).

From what I have been told and in my research assuming that the violations were in place as of the effective date then neither the base As Is Contract nor the HOA rider would provide the Buyer any recourse against the Seller to remedy any HOA violations.

The HOA recorded documents may however not allow a certificate of approval of the sale to be issued until the Property is brought into compliance and a certificate of approval is typically required by the Title Agent to prove compliance with the verbiage of the recorded documents that all sales be approved by the association.

Why are real estate taxes so high in Florida?

The tax man cometh and Florida is no different. Although we do pay our fair share of real estate tax the over all tax rate is one of the lowest in the nation.

| Aside from the obvious benefit of Florida’s warm climate, Florida’s beneficial treatment of homestead assets, as well as the fact that there is no State estate tax or nor a State income tax are all major reasons that people choose to relocate to Florida. These benefits are only available to U.S. citizens and green card holders. Florida homestead exemption allows for an unlimited protection of a homesteaded property. The tax benefits center around two primary issues. The first of which, is the fact that Florida has no State estate tax. We have many Florida resident clients who are former New York residents and who still maintain property in New York. Upon their passing, their New York properties will be subject to the New York State estate tax (in addition to the Federal estate tax) and these properties will also be subject to ancillary probate proceedings. This means there would need to be two probate proceedings, one in Florida and one in NY. To these individuals we recommend creating a revocable trust and transferring title of the New York properties into the Florida trust. The second tax benefit is that there is no Florida State income tax, but that only applies to income produced in Florida. If you own rental properties say back in New York or Massachusetts then you will ne to pay that state income tax. |

How does the date of construction affect your wind storm insurance?

The wind storm mitigation discount is is determined by the year the building permit was issued

When answering section one of the Wind Mitigation Inspection form the critical issue is on what date was the building permit for the construction of the house issued. For permits issued after March 1, 2002 the house would have been constructed pursuant to the 2001 Florida Building Code. You should receive a reduction of your hurricane insurance premium. Furthermore section one of the wind mitigation form treats all house construction permits issued after this date equally. This is not true for all of the other sections of the Wind Mitigation Inspection form.

The new 2001 Florida building Code required the use of better materials for certain components of the home. Homes built under the 2001 Building Code are more likely to withstand a hurricane. That is why the permit date is important in the Wind Mitigation Inspection Report.

Any house constructed under a building permit issued BEFOR March 1, 2002, the effective date of the 2001 Florida Building Code, pays a higher insurance premium than a house constructed under a permit issued after March 1, 2002.

- « Previous Page

- 1

- …

- 54

- 55

- 56

- 57

- 58

- …

- 149

- Next Page »