Can I rent out my Casita in Alton? The short answer is: Yes, you can. The more involved answer is for the question: Should I?

Thinking of renting out your Casita? Give me a call and I will be happy to assist you, Chris Ryder 561.626.8550/

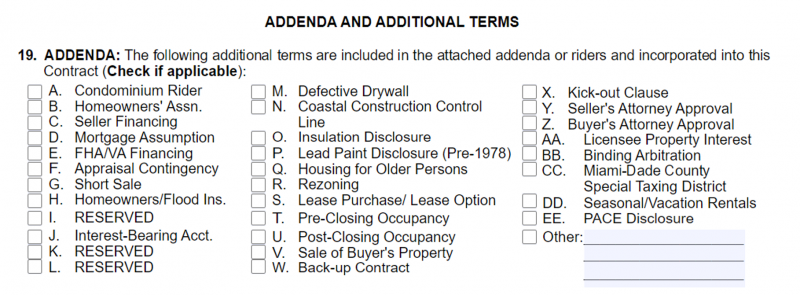

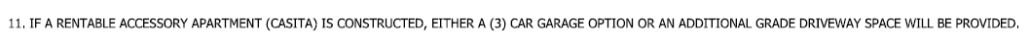

When Alton was appoved by the City of Palm Beach Gardens they did so with an approval of what was termed a “rentable accessory apartment”.

Thus, you may legally rent out the Casita in Alton. Technically this would require a business tax receipt from the city.

Should you? Well, it’s only for the money BUT be aware that in doing so you may jeopardize at least a portion of your Homestead Exemption. If your property is homesteaded then it is supposed to be used ONLY for YOU to reside in. You may work from home BUT if you lease out a portion of the property accessory giving others the exclusive right to occupy it an you may only enter it as a Landlord then the property is being used as a business. The Florida Supreme Court recently rules that a person who had a homestead in place but rented part of it (rooms within the property) to others for their exclusive use were not entitled to the full homestead exemption. They got the exemption on the space they utilized but lost it for the rooms. The property appraiser estimated the space rented out to be 15% of the total SF and sent the Owner a bill, plus penalties and interest.