LAST UPDATED IN 2025

I looked into this once again for a new listing at 10095 176th Ln in Jupiter Farms. A few years ago the rules were changed and the answer now applies to ALL unicorporated parcels in Palm Beach County. In 2023 PB County changed the rules for Accessory Quarters or what most folks call “Accessory Dwelling Units” (ADU’s).

First, this is general information. If you really want to know for certain then call the Palm Beach county Planning & Zoning Department (561.233.5200) with your property parcel ID and speak to the “planner on call”, then hire an engineer ot architect, then a builder. Look your house up on PAPA and IF the first 2 digits are “00” the you are in unincorporated Palm Beach County. Then use this link to get the zoning information for your property and jot it down or print it out. Tired of dealing with Realtors who don’t know details like this? Call Chris Ryder at 561-626-8550. A word of caution as well. IF you plan to rent this unit out you will lose at least a portion of your homestead exemption. The Florida Supreme Court ruled in Furst v. Rebholz that a homeowner cannot claim a full homestead tax exemption if they rent out a portion of their home.

The short answer: Yes, in Jupiter Farms, and in fact now for ANY residential zoned property in Palm Beach County, one may have what is termed an “Accessory Quarters” BY RIGHT. For lots in unincorporated Palm Beach County that are over 1 acre in size one may build a, “Accessory Quarters” A/K/A “mini house” or “Accessory Dwelling Unit”, so long as it is not separtely metered for electric from the main house, having under 1000 SF (800 SF for lots under 1 acre) of air conditioned living space PLUS up to an additional 500 SF of area “under roof.” That’s an area under a solid roof that is utilized by the unit such as a porch, patio, porte-cochère, carport, or garage is allowed.

This provided you have the “space”. These must meet the set backs and not exceed things like the lot coverage ratios. The ADU must be built to correct elevation, being 2.5′ above the adjacent road for places OUTSIDE the Flood Zone like Jupiter Farms, it must be under 25′ in height, and must be built with the correct set backs from the side and rear property lines…

Residential Zoning Districts and AR Lots Less than One Acre

Accessory structures ten feet or less in height shall meet a minimum five-foot setback from the side and rear property lines. Accessory structures over ten feet in height shall meet the minimum setbacks in Table 3.D.1.A, Property Development Regulations. [Ord. 2016-042] [Ord. 2023-009] [Ord. 2023-021]

(2) Within AR Zoning District on Lots One Acre and Greater

Accessory structures shall be set back from the side and rear property lines as follows: [Ord. 2023-009]

(a) Lots five acres or greater; minimum of 25 feet. [Ord. 2023-009]

(b) Lots one acre or greater and less than five acres; minimum of 15 feet. [Ord. 2023-009]

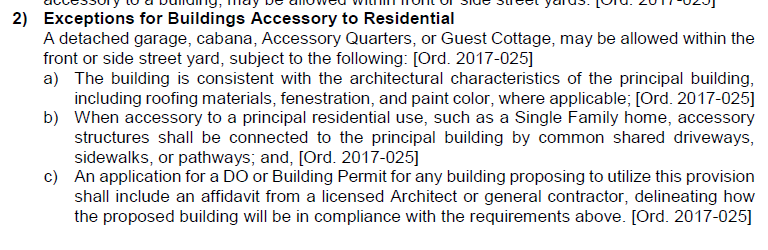

There is even a possibility to build it in the front of the house though not “by right.”

Acessory uses are covered in Article 5. And for Residential Districts, like the AR and RE found in Jupiter Farms.

Residential Districts

Accessory structures shall be allowed subject to the requirements below, provided they are not located in an established easement or required landscape buffer unless exempted by Art. 5.F.2.A, Easement Encroachment.

But first we must check that we can do ANYTHING because there are “max building coverage” requirements in the code which we see in the above Table is 15%. For the typical 1.25 acre lot (> 1 Acre) let’s assume it has a descent sized 4,000 sf house on it. This is the total size of the building(s) (ALL BUILDINGS WITH A ROOF ON THEM) but would not include a pool or a screen enclosure, UNLESS it has a solid roof. But if you have other structures on your lot like a detached garage, stable, barn, pole barn, lien to, or ANYTHING WITH A SOLD ROOF then these WOULD BE ADDED to the 4,000 SF house roof area number I am using.

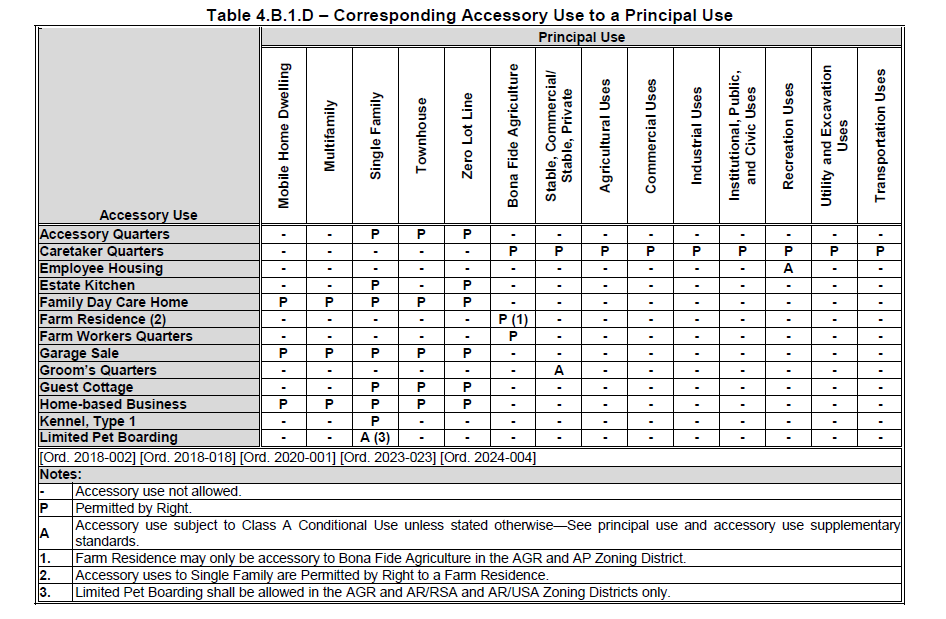

So let’s look at an example. A lot that it 165′ wide X 330′ deep. This is 1.25 Acres and thus an ‘existing non conforming’ lot for the AR (RR-10). Looking at Table 3.D.1.A again and we see that lot coverage must be less than 15%, so 0.15*165*330 = 8,167.5 sf. In this example we could have an accessory building that’s 8,167.5 – 4000 = 4,167.5 SF. A good sized barn but we want to know about ADU’s now that we know we have over 4k SF of have lot coverage to use! Looking at table 4.B.1.D we see that for a Single Family Principle Use one may have BY RIGHT Accessory Quarters, Estate Kitchen, or a Guest Cottage…

What we are looking for is the “Accessory Quarters” BUT if you do not have the lot size (coverage) or set backs for this then perhaps look into IF an Estate Kitchen would be allowed and do want you want.

Accessory Quarters

a. Definition

A complete, separate living facility equipped with a kitchen and provisions for sanitation and sleeping, located on the same lot as the owner-occupied principal dwelling.

b. Building Area

The use shall be subject to the following:

1) On less than one acre: a maximum of 800 square feet.

2) On one acre or more: a maximum of 1,000 square feet.

3) The floor area calculation shall include only the living area of the Accessory Quarters under a solid roof.

4) Additional floor area under a solid roof that is utilized as a porch, patio, porte-cochère, carport, or garage shall not exceed 500 square feet.

So, for our example one may have a 1,000 SF of living area (air conditioned building space) plus another 500 SF of porch, patio, porte-cochère, carport, or garage (non AC space) and it must be placed at least than 25′ from the both the rear and side property lines.

An “Estate Kitchen” is “A second kitchen located within a principal Single Family, Zero Lot Line, or Farm Residence.”

A “Guest Cottage” is much like an Accessory Quarters BUT it is intended only for sleeping and is WITHOUT a kitchen.

Last FYI is that the accessory building MAY NOT have separate utilities and that you will be charged Impact Fees in addition to the building permit fees.