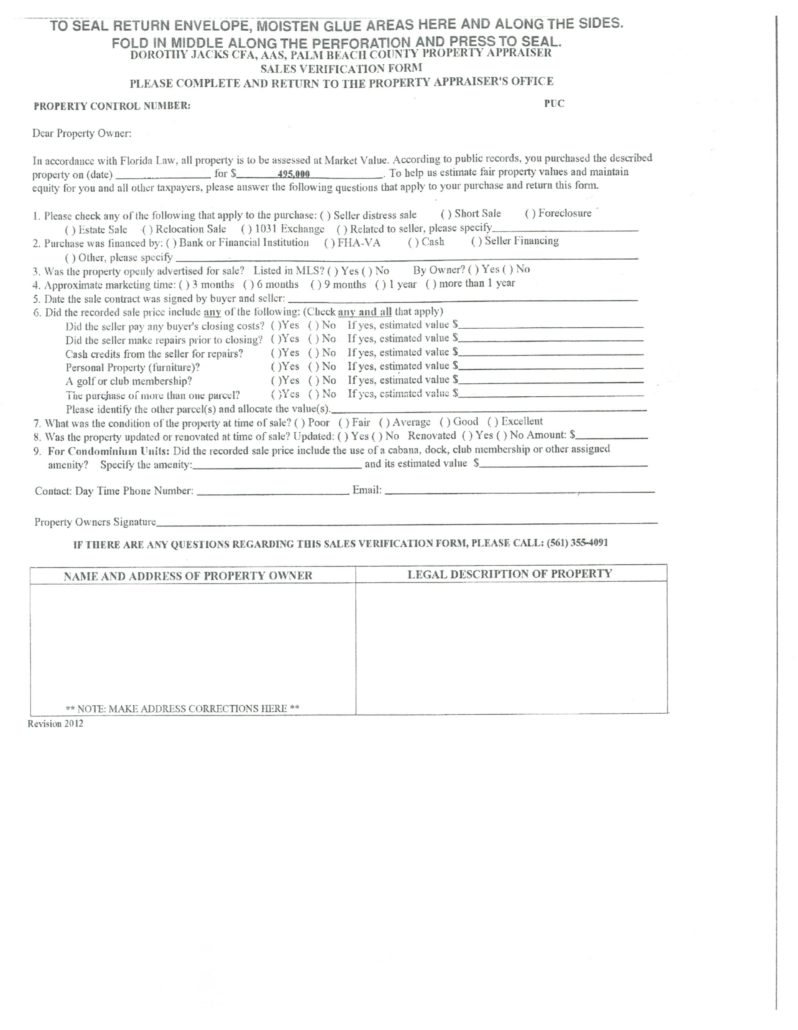

I typically get a call on this one from customers about a month after they have closed asking what to do with this form. Until recently my stock answer was to throw it out. This was based on the basic assumption of everything you say can and will be used against you. If I ever wanted to apply for an abatement then this would be in the records of the appraiser. The goal here is, presumably if you are going to fill this out all, to convince the tax man that you paid MORE than fair market for the property.

OK, so here’s what I found out:

- This form is no place on the property appraisers web site.

- It is mailed to new owners who are NOT REQUIRED to fill it out nor send it back. Some people sign it and mail it back without anything filled in.

- When should you fill in the answers? Well, if the purchase price as shown on the deed was for something OTHER THAN the real property.

- Question 1: I would NOT answer as most of these would lead to the logical conclusion that the price on the deed reflects some form of distressed sale. If it is a distressed sale then it is NOT included in the mass appraisal numbers and by definition you paid below market value.

- Question 2: On this one, if the Seller financed the sale it’s probably a good bet the Buyer paid MORE than fair market for the property. If this is the case then check that box. FHA-VA, you MAY have paid a bit more that the market would bear but it’s tough to tie that one down. Basically the FHA VA loans are more difficult to close, so lower probability of closing and higher contract price required to entice the Owner to sell to this person.

- Question 3: If the property was not in the MLS then you probably paid below market. Don’t tell the appraiser this. BTW, the County Property Appraiser has access to the MLS data set.

- Question 4: Don’t answer

- Question 5: If there was a longer than normal Under Contract period then this benefited one party or the other.

- Question 6: What you want to do here is inform the Property Appraiser of any of these. Typically the Seller will pay for the doc stamps on the deed, an owners title policy and the fee for the closing agent. Any repairs? If so then the Seller had expenses in the sale. Cash credits? Same answer. Personal property? Almost always yes. Think refrigerator, microwave, stove, dishwasher, clothes washer and dryer and any of course furniture. Membership? The sales price in golf communities are typically lower than surrounding communities. These are not usually in the purchase price UNLESS there is seller financing as they are NOT financeable. More than one parcel? The place where this might happen is in places like Mariners Cove which has docks and those docks have parcel id numbers. This info is typically right on the face of the deed.

- Question 7: Condition? Well, if it was a dump then you probably paid BELOW market.

- Question 8: Updated or renovated? Same logic as above. Updates are things done without a permit, renovations require a permit.

- Question 9: Assigned amenity? Think of a community like Twelve Oaks where the boat slip is an assigned right of use. You would not pay tax on that value ONLY on the real property you own. TELL THEM ABOUT IT.

Finally, check the name and address and make any corrections.