As of November 1 2021 the new version (6) of the FAR BAR As-Is is in effect and the financing paragraph changed ALLOT. We are now back to the way it once was which is to say that, for the financing section, the appraisal MUST be completed within the Loan Approval Period. And the ONLY thing that MAY remain remain as a contingency AFTER the end of the Loan Approval Period is: “Property related conditions of the Loan Approval (specifically excluding the Appraisal valuation) have not been met unless such conditions are waived by other provisions of this Contract;”

OK, so here’s a question I never thought I would be asked. Can I have Contract subject to Loan Approval (so NOT cash) and remove the appraisal language?

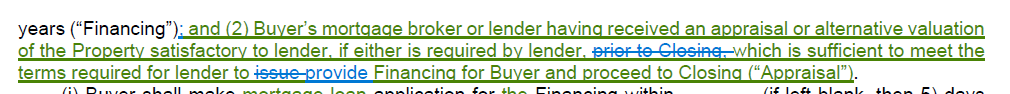

Short answer is YES, but it’s VERY risky. Both parties can agree to strike that language from the financing paragraph and that would remove the ‘out’ for the Buyer should the Property fail to appraise. So, the Buyer is approved BUT the house is NOT because it did not appraise. THIS IS VERY RISKY AND ALMOST SURE TO CAUSE A FIGHT OVER RELEASE OF ANY ESCROW FUNDS. This is the new version of the appraisal language…

Or, one could use language similar to something like this ASSUMING that the loan product allows for the Buyer to ‘make up the difference’ on the Loan:Value.

“Should any appraisal of the Property (ordered either by the lender for the Buyer, by the Buyer themselves or any others) indicate that the value of the Property is less than the Purchase Price then the Buyer will proceed as if the appraised value of the Property is equal to or in excess of the Purchase Price.” And, again of course, the Lender must be OK with this. Be aware that this is NOT standard language and should be drafted by a lawyer to protect both parties.

So, if the Property fails to appraise BEFORE Loan Approval is given and the application fails to meet underwriting guidelines because of this, AND ONLY THIS, then the application could be denied by the Lender (they can do whatever they want) BUT the Buyer (IMO) could NOT withdraw from the Contract without penalty. Section 8(b)(1) was satisfied and 8(b)(2) was struck in this instance. That’s way too risky for most folks.

Read THIS POST to see why a Buyer would want a separate addendum to the Contract for an appraisal