So, despite our best efforts my property is now shown inside a Special Flood Hazard Area or SFHA. So what does that mean? How much will my rate go up and when?

FEMA Flood Insurance and the Grandfathering Rule has some great information in it.

First, because you are now in a Special Flood Hazard Area your lender will require you to carry flood insurance. This is also true of anyone who buys your house and uses a loan.

Second, statistically you just lost money. How much is up for debate but one study I saw looking at homes in a newly mapped SFHA after Sandy placed the lost value as some place between 8 and 9%.

If you are located in a newly mapped flood zone AND YOU HAVE A FLOOD POLICY, then FEMA will send you a form Letter F. This is your official heads up but be aware that your insurer AND the company hired by your lender (a/k/a Core Logic) will NOT rely upon this determination letter.

So, what are my rates going to go up to?

Let’s look at my house as it’s a pretty straight forward. I’m in a Shaded Zone X and with the new maps I will be in a Zone AE (SFHA). I have in effect a preferred risk policy which is about $450/year for 250k of building coverage and 100k of contents coverage.

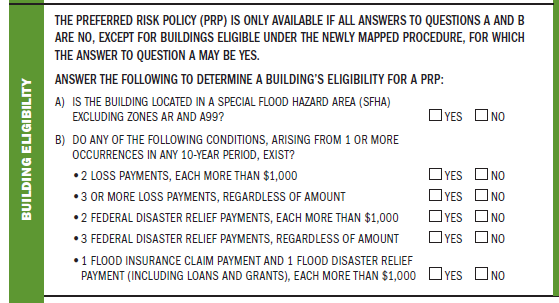

Because I have a policy in place (or placed within 12 months of the adoption of the new FIRM) and because I am in a newly mapped SFHA then my new rates may be based upon those for a property newly mapped into an SFHA. I live in a Florida standard single story CBS home built on a slab on grade BEFORE THE FIRM MAPS WERE ADOPTED in my town (Pre FIRM) without a basement or “enclosure” and because I can answer No to everything under B) below…

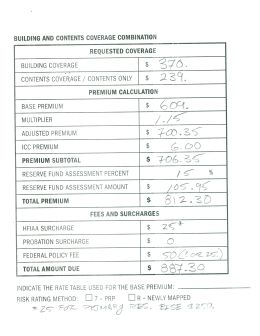

The property is eligible for the rate table used for properties newly mapped into an SFHA on or after October 1, 2008 which for a home without a basement or enclosure is $370. for 250k of coverage on the building plus $239 for 100k of coverage on the contents. I filled in this FEMA Form 1660 Table below…

So, my policy is going to go up next year to about $900 and will go up every year after that (at a rate not to exceed 18%) until the full policy rate is met. So what’s that number? What’s the ceiling look like?

Because I am in a newly mapped SFHA area and I have a policy in effect then my new ‘market’ rates MAY be based upon those for my old zone. I live in a Florida standard single story CBS home built on a slab on grade BEFORE THE FIRM MAPS WERE ADOPTED in my town (Pre FIRM) without a basement or enclosure and thus my rate for the building coverage is 1.10/.30. That’s 1.10 for every $100 of the first $60,000 (Basic) of coverage on the structure and 0.30 for the next $190,000 (additional) coverage.

My 250k policy on the structure will go up, eventually, to (60,000/100)*1.10 + (190,000/100)*0.30 = $660. + $570. = $1,230 per year for the structure. And for the contents coverage it is 1.67 for every 100 of the first 25k and 0.53 for every 100 of the next 75k and thus the contents coverage is going to $422.50 + $397.50 = $820. 1230+820 = $2,050.

My policy is going from +/-$450. per year for a preferred risk policy, to 900 in the first renewal year for a newly mapped policy, increased each year until I get to a newly mapped policy in Zone AE BUT based upon the Zone X rate table for pre FIRM constructed home which brings it to $2,050 per year. Again, there is a ramp up period in this, but at the end of it (about 7 years at 18% compounded), this will be the premium.

Now, if I did NOT qualify for the newly mapped flood zone policy rate then my same pre FIRM constructed house in a Zone AE with a 250/100k policy would cost $4,361.50 less the say 25% discount for a favourable CRS of 5 (North Palm Beach is now a 7 so it’s currently 15%) then the premium is at least $3,271 with NO ramp up period.

| Property | 250000 | 60000 | 190000 | |||

| Contents | 100000 | 25000 | 75000 | |||

| Zone X | ||||||

| Pre FIRM | 1.1 | 0.3 | ||||

| Zone X | 660 | 570 | 1230 | STUCTURE | ||

| 1.69 | 0.53 | 2050 | TOTAL | |||

| 422.5 | 397.5 | 820 | CONTENTS | |||

| Pre FIRM | 1.12 | 1.03 | ||||

| Zone AE | 672 | 1957 | 2629 | STUCTURE | ||

| 1.41 | 1.84 | 4361.5 | TOTAL | |||

| 352.5 | 1380 | 1732.5 | CONTENTS | |||

So, it is apparent to me that having a policy in place is the way to go. One starts off at 900/year but it also maxes out at the lower rate for the Shaded Zone X ($2,050) instead of the Zone AE ($4,361.50).