I started to look into this today and I was shocked. Before we get to that the CRS is basically a rating system for communities and how well they adhere to the National Flood Insurance community standards for things like building codes and flood plain management. If your community is great at it then you (the property Owner) get a % off your flood insurance premium. There’s a table for all the cities and towns and these are few in Northern Palm Beach County

| Location | CRS | SFHA | NON SFHA | Status |

| Palm Beach County | 5 | 25 | 10 | C |

| Jupiter | 5 | 25 | 10 | C |

| North Palm Beach | 7 | 15 | 5 | C |

| Palm Beach Gardens | 10 | 0 | 0 | R |

| Juno Beach | 5 | 25 | 10 | C |

| Tequesta | 7 | 15 | 5 | C |

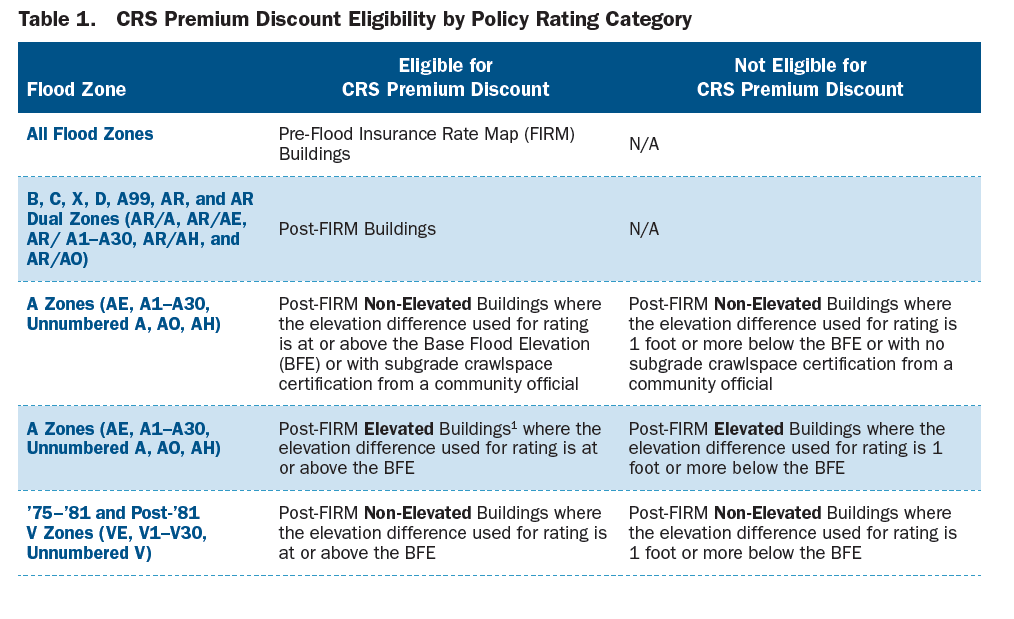

So, let’s say I live in the Village of North Palm Beach in a home built before the adoption of the FIRM panels which is to say it was built before 15 August 1978 for North Palm Beach. Since it is a pre-FIRM building then all flood zones qualify to the 15% discount.

If the property was built AFTER 15 August 1978 and is now in the SFHA Zone AE then the finished floor elevation must be equal to or greater than the Base Flood Elevation which is currently proposed to be 7′ (NAVD) in order to qualify for the discount.

The shocked part comes from 2 points. First, looking at the CRS for the various communities. Palm Beach Gardens homes get NO DISCOUNT and the R in the table stands for Rescinded. Those in the unincorporated PB County areas, Jupiter and Juno Beach get a 25% discount, while homes in Tequesta and North Palm Beach get a 15% discount. So a home such as 13958 Chester Bay in Frenchman Harbour will pay 10% less in flood insurance than those in say Harbour Isles . The second part is that the CRS discount does NOT apply to newly mapped policies.