Source: Mold Rider Confusion: ‘AS IS’ vs. Residential Contract

Riders to Contract

Mold Rider Confusion: ‘AS IS’ vs. Residential Contract

By Meredith Caruso

Contract lesson No. 1: Make sure one contract’s rider works with other contracts. Lesson No. 2: The Mold Inspection Rider only applies to the standard FR/Bar contract because the “AS IS” version doesn’t need it.

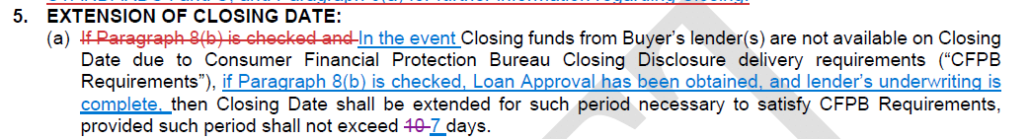

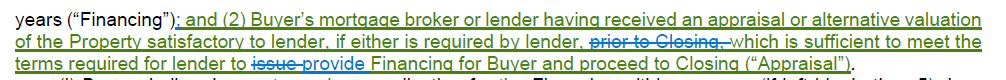

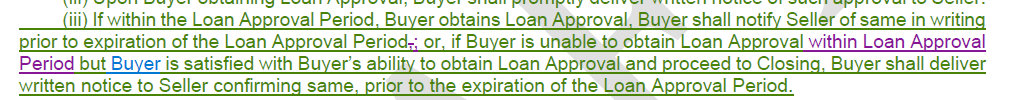

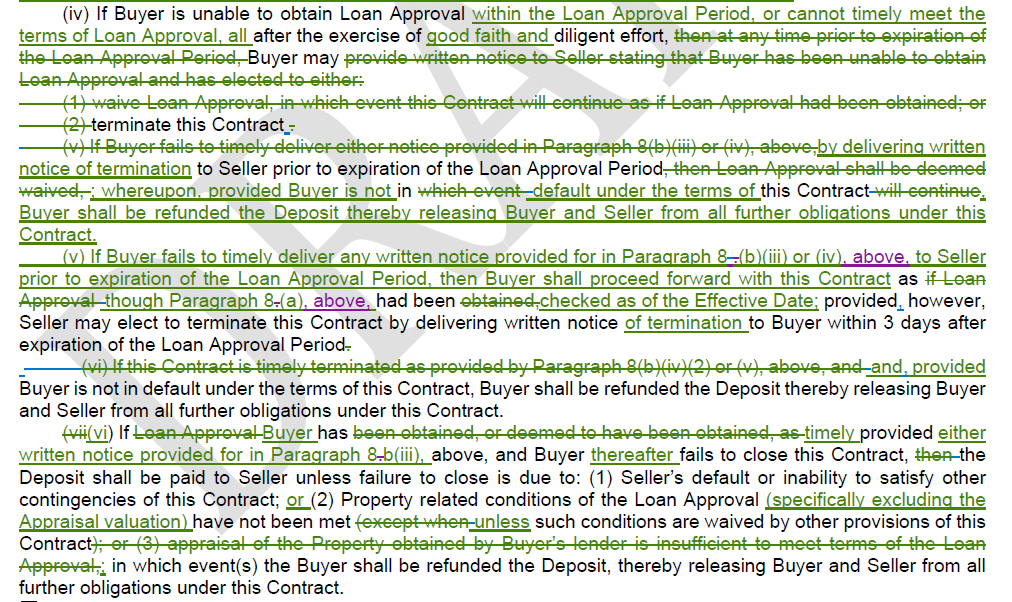

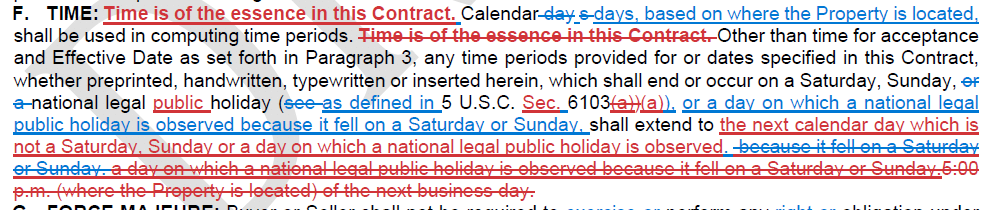

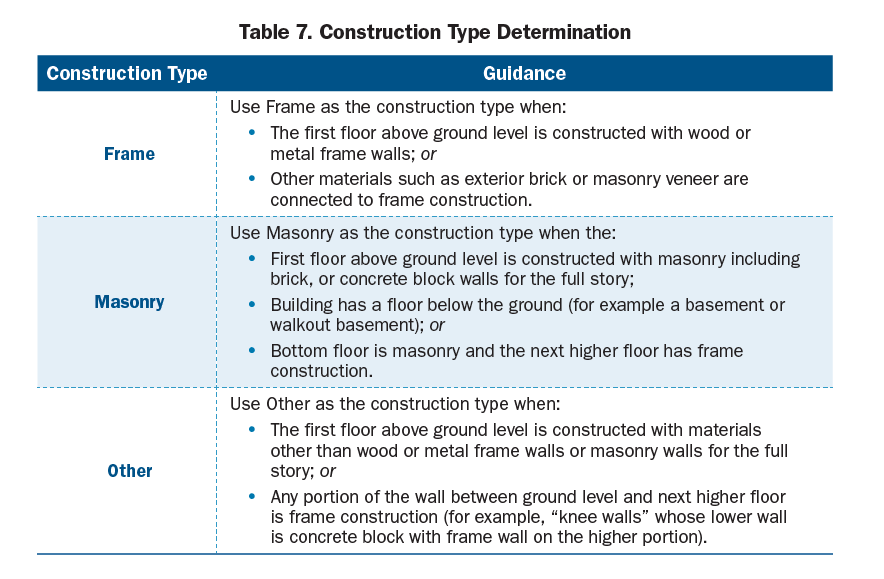

ORLANDO, Fla. – Florida Realtors Legal Hotline calls indicate some confusion over the use of the new Florida Realtors/Florida Bar Comprehensive Rider, I. Mold Inspection. Let’s take a look at this new form and walk through when to use it and, more importantly, which contract to use it with. Most members know that the Florida Realtors/Florida Bar Residential Contracts for Sale and Purchase (FR/Bar) contain a section specifically dedicated for the Comprehensive Riders that may be being used in a certain transaction. This is paragraph 19 of both contracts, entitled “Addenda.” Paragraph 19 lays out the various comprehensive riders that can potentially be used in a transaction and labels them A., B., C., etc. What many members may not realize? Not all riders work with both contracts. I will say that again: Not all of the comprehensive riders to the FR/Bar contracts are intended to work with both FR/Bar contracts. Let’s take a deeper dive using the Mold Inspection Rider to see why. First, let’s compare paragraph 19 of the standard FR/Bar contract to that of paragraph 19 of the “AS IS” FR/Bar contract. Here is paragraph 19 of the standard FR/Bar Contract: 19. ADDENDA: The following additional terms are included in the attached addenda or riders and incorporated into this Contract (Check if applicable):  And here is paragraph 19 of the “AS IS” FR/Bar Contract: 19. ADDENDA: The following additional terms are included in the attached addenda or riders and incorporated into this Contract (Check if applicable):

And here is paragraph 19 of the “AS IS” FR/Bar Contract: 19. ADDENDA: The following additional terms are included in the attached addenda or riders and incorporated into this Contract (Check if applicable):  For the most part, the riders match up per letter on both contracts. However, you will note several comprehensive rider letters marked “RESERVED” on the “AS IS” FR/Bar contract in paragraph 19. What does this mean? That no corresponding rider goes with that particular contract version. In other words, the rider you see in paragraph 19 of the standard FR/Bar contract isn’t intended to be used with the “AS IS” FR/Bar contract. The obvious next question is: Why not? Let’s look at what those particular addenda are to see why their use isn’t intended with the “AS IS” version of the FR/Bar contracts. Comprehensive Rider I., Mold Inspection, is listed as reserved on the “AS IS” version of the contract because the “AS IS” version of the FR/Bar contracts gives buyers an inspection period for any and all inspections they may want to complete. “Any and all” includes a mold inspection. The “AS IS” version also allows a buyer to cancel for any reason as long as the buyer is doing so within the inspection period. So, a buyer with the “AS IS” version of the FR/Bar contract could perform a mold inspection during the buyer’s inspection period, be unsatisfied with the presence of mold, and choose to terminate the contract as a result. There is no need for any mold rider because a buyer’s ability to perform a mold inspection and terminate is already built into the main body of the “AS IS” contract’s language. However, if a buyer is using the standard FR/Bar contract, there is a repair standard for certain types of repairs uncovered during the buyer’s inspection period. As the language in the standard FR/Bar contract didn’t directly address mold, this rider was created to give buyers a possible “out” if they find the presence of mold and remediation exceeds a certain dollar amount. Note: This rider does not obligate the seller to fix or repair any damage based on the presence of mold; instead, it allows a buyer to terminate the contract if a mold inspection reveals the presence of mold, and remediation or repair costs are higher than a specified amount set forth in the rider. As a matter of clarification, the other two “RESERVED” spots on the “AS IS” version of the FR/Bar are for using an “AS IS” rider or a “Right to Inspect/Cancel” rider. As stated above in my explanation on the Mold Rider, there is no need to use these riders with the “AS IS” version of the FR/Bar contracts based on the same reasoning: The language is already in the “AS IS” version. In other words, you wouldn’t attach the “AS IS” rider to the “AS IS” contract. If you did, you’d be effectively saying the same thing twice. Understanding the riders and how they operate between the two versions of the FR/Bar contract is an important step in adequately representing buyers and sellers. Hopefully this article helps you stay on the right path to many successful transactions. Meredith Caruso is Associate General Counsel for Florida Realtors Note: Advice deemed accurate on date of publication © 2021 Florida Realtors®

For the most part, the riders match up per letter on both contracts. However, you will note several comprehensive rider letters marked “RESERVED” on the “AS IS” FR/Bar contract in paragraph 19. What does this mean? That no corresponding rider goes with that particular contract version. In other words, the rider you see in paragraph 19 of the standard FR/Bar contract isn’t intended to be used with the “AS IS” FR/Bar contract. The obvious next question is: Why not? Let’s look at what those particular addenda are to see why their use isn’t intended with the “AS IS” version of the FR/Bar contracts. Comprehensive Rider I., Mold Inspection, is listed as reserved on the “AS IS” version of the contract because the “AS IS” version of the FR/Bar contracts gives buyers an inspection period for any and all inspections they may want to complete. “Any and all” includes a mold inspection. The “AS IS” version also allows a buyer to cancel for any reason as long as the buyer is doing so within the inspection period. So, a buyer with the “AS IS” version of the FR/Bar contract could perform a mold inspection during the buyer’s inspection period, be unsatisfied with the presence of mold, and choose to terminate the contract as a result. There is no need for any mold rider because a buyer’s ability to perform a mold inspection and terminate is already built into the main body of the “AS IS” contract’s language. However, if a buyer is using the standard FR/Bar contract, there is a repair standard for certain types of repairs uncovered during the buyer’s inspection period. As the language in the standard FR/Bar contract didn’t directly address mold, this rider was created to give buyers a possible “out” if they find the presence of mold and remediation exceeds a certain dollar amount. Note: This rider does not obligate the seller to fix or repair any damage based on the presence of mold; instead, it allows a buyer to terminate the contract if a mold inspection reveals the presence of mold, and remediation or repair costs are higher than a specified amount set forth in the rider. As a matter of clarification, the other two “RESERVED” spots on the “AS IS” version of the FR/Bar are for using an “AS IS” rider or a “Right to Inspect/Cancel” rider. As stated above in my explanation on the Mold Rider, there is no need to use these riders with the “AS IS” version of the FR/Bar contracts based on the same reasoning: The language is already in the “AS IS” version. In other words, you wouldn’t attach the “AS IS” rider to the “AS IS” contract. If you did, you’d be effectively saying the same thing twice. Understanding the riders and how they operate between the two versions of the FR/Bar contract is an important step in adequately representing buyers and sellers. Hopefully this article helps you stay on the right path to many successful transactions. Meredith Caruso is Associate General Counsel for Florida Realtors Note: Advice deemed accurate on date of publication © 2021 Florida Realtors®