108 Rainbow Fish Circle is a single family home located in the gated neighborhood of Ocean Walk, across from the beach in Jupiter, Florida. This 3 bedroom, 3 bathroom, 2 garage home is light, bright and spacious. Newly renovated the home has an open white kitchen, with a large island. The home also has a wood burning fireplace, vaulted ceilings, large master bedroom with balcony, pool and outdoor entertaining space, impact glass and sauna. The home is located in the delightful gated neighborhood of Ocean Walk with low HOA and beach access. Ocean Walk is conveniently located close to the beach, shops and restaurants. Ocean Walk is gated and allows pets, but trucks and vans must be kept in a garage. Rentals are permitted up to twice a year, a minimum of three months. Florida living at its best, this home is a hidden gem!

Converting the elevations given on old flood FIRM maps from the NAD 83 TO NAVD 88 datum.

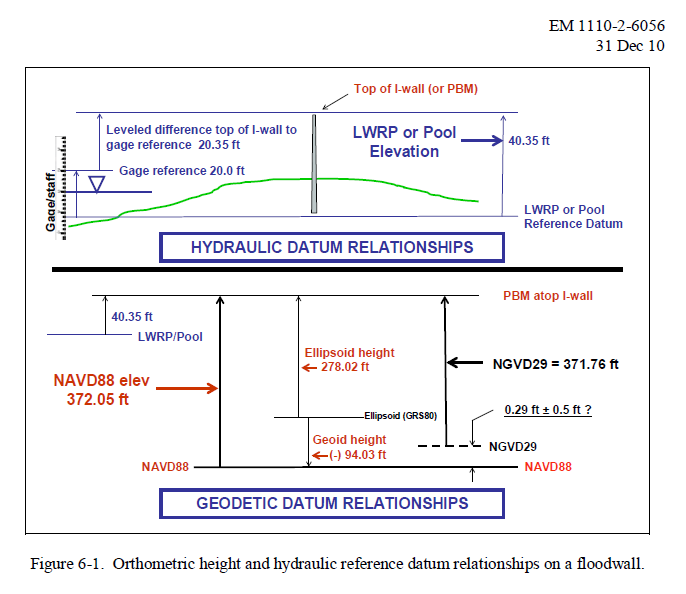

This is a bit of a rehash on a post I did some time ago on converting elevations from the older NGVD 1929 standard to the now in use NAVD 1988 standard. I noted the other day in looking at the previous version of a flood map for the Palm City area that it gave the Base Flood Elevation in terms of the NAD 83 (GRS 80) datum. I suspect that some folks have elevation certificates or construction documents which give elevations of their homes in this datum so I wanted to cover it. And sort of compare the 3. First, the NGVD 1929 and NAVD 1988 datums are what are know as Orthometric where the the NAD 83 is an Ellipsoidal Datum.

The datum is defined as: Datum: A reference surface used to ensure that all elevation records are properly related. The National Flood Insurance Program previously used the National Geodetic Vertical Datum (NGVD) of 1929 but all recently adopted FIRMs have used the North American Vertical Datum (NAVD) of 1988. Historic Elevation Certificates may use any one of these but newer ones use either the 1929 or 1988 datums. Both of these datum planes express elevations in relation to “sea level”. So, when we see on the new flood zone map something like ZONE AE (EL 6) this means that the Base Flood Elevation (BFE) has been determined and it is 6 feet above the datum stated on the map which again, for newer FIRMS, is NAVD 1988. This is what is referred to as Datum Shift. They quite literally moved zero.

Here’s the bottom line. After looking literally everywhere for this answer I found it in an Army Corp paper and what I was able to determine is that in terms of the vertical elevations the NAVD 1988 elevations are the same as the NAD 83 (GRS80) elevations shown on some older FIRM’s.

Legal Hotline: How Should I Field Multiple Offers?

It’s rewarding to see pre-listing work pay off when a seller receives multiple offers – but now what? There are many options with just a few rules to keep in mind. Here’s one that’s true across the board: Be honest.

A great article on multi offer situations including the note that “As for the terms contained in any given offer, there is no default obligation of confidentiality. So, unless a buyer has included a specific confidentiality agreement with the offer, the seller is typically allowed to share the details of that offer with whomever the seller chooses.”

Condo Q&A: Amending Documents, Bylaws and Boards

Is it acceptable for a condo association to “self-insure” and cancel their current insurance? Also: Can a board avoid naming a director to an empty position?

Question: My cooperative dock association board of directors is exploring the ability to “self-insure” by cancelling the wind coverage on the docks and increasing the reserves. The present windstorm insurance is almost half of the annual budget and is effectively useless due to the deductible. The board thinks they can do this by amending the governing documents to remove the insurance requirement. Can this be done?

Answer: Probably not. While the governing documents can be changed by an amendment, the documents cannot be changed to circumvent the requirement of the Cooperative Act. Specifically, F.S. 719.304(3) which requires a cooperative association to insure all association property. In a cooperative, the association “owns” the docks and leases them to the members. So, the statutory requirement that the association insure “association property” includes the “docks” even though Statute 719.104(3) does not literally use the word docks.

The Cooperative Act also allows an association to “self-insure” as an alternative to traditional insurance. However, “self-insurance” is not simply maintaining reserves. It is controlled by Florida Statute 624. To boil it down, it requires the association to essentially create its own insurance company and fund it. It is extremely complex and cost prohibitive in the sense of the actual savings.

Source: Condo Q&A: Amending Documents, Bylaws and Boards

600 Ocean Drive 2A, Juno Beach

600 Ocean Drive 2A, Juno Beach is located directly on the ocean in the Horizon condominium building in Juno Beach, Florida. Rarely available 3 bed, 2.5 bath oceanfront, this condo is a great find. Enjoy stunning ocean views from this spacious second floor unit with a wrap-around balcony. This building has plenty of parking, a rec room, pool and direct beach access. One pet under 30lbs is permitted. Call R&R Realty at 561-626-8550to schedule a viewing today.

150 Bella Vista Court N

150 Bella Vista Court N is located in Bella Vista on the Park in Jupiter, Florida. This three bedroom, 2.5 bath unit is located on Carlin Park by Jupiter Beach. The unit has an open floor plan with a renovated kitchen with white wood cabinets and stainless appliances and light and spacious living and dining areas with high ceilings. Stairs lead up to a loft area, bedrooms and an open balcony. The unit has a newer water heater and the air conditioning unit was replaced in 2019. The community has a swimming pool and tikki area, tennis courts, raquetball court, bocce ball, and walking trail. Rentals are permitted and these units make great investments. The HOA fees cover exterior building maintenance and exterior building insurance. Bella Vista is a short distance from the beach, grocery shopping, Harborside shops and restaurants and the Maltz Theater. Pack your beach chair and flip flops, this is a great beach pad!

- « Previous Page

- 1

- …

- 68

- 69

- 70

- 71

- 72

- …

- 164

- Next Page »