OK, here’s something new to watch out for that was just in the news:

BUYING A HOUSE WHICH HAS MADE ONE OR MORE FLOOD INSURANCE CLAIM(S).

Here’s the way it is right now. The National Flood Insurance Program (NFIP) in an attempt to limit properties which make multiple claims on the NFIP has defined problematic properties into two categories, Repetitive Loss properties and Severe Repetitive Loss properties.

A Repetitive Loss (RL) property is any insurable building for which two or more claims of more than $1,000 were paid by the National Flood Insurance Program (NFIP) within any rolling ten-year period, since 1978. A RL property may or may not be currently insured by the NFIP.

A Severe Repetitive Loss Properties (SRL) which is a single family property (consisting of 1 to 4 residences) that is covered under flood insurance by the NFIP and has incurred flood-related damage for which 4 or more separate claims payments have been paid under flood insurance coverage, with the amount of each claim payment exceeding $5,000 and with cumulative amount of such claims payments exceeding $20,000; or for which at least 2 separate claims payments have been made with the cumulative amount of such claims exceeding the reported value of the property.

And now the administration would like to add a new category called Extreme Repetitive Loss Properties AND they want to stop issuing new policies for new construction homes built in the Special Flood Hazard Area (SFHA). SFHA areas are designated on the flood insurance rate map as Zone A, AO, A1-A30, AE, A99, AH, AR, AR/A, AR/AE, AR/AH, AR/AO, AR/A1-A30, V1-V30 or V.

OK, so what is the problem here? First the current law. If you are buying a home which has had even a single $1000 claim made then you have a flood loss and make a claim you could wind up owning a property which has made 2 claims IN THE LAST 10 YEARS and being classified as a ‘Repetitive Loss’ property. The stigmatization of this will adversely affect the property value and drive up your insurance costs if you stay.

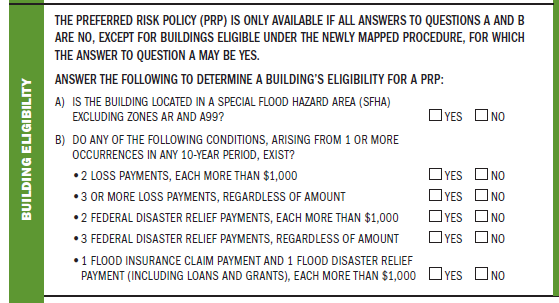

As a practical matter, there are only about 50 or so repetitive loss properties in Palm Beach County. If you answer YES to any of the B) questions below then that’s a problem…

If changes are made to stop issuing policies in the SFHA it will affect in fill and tear downs in communities like Lost Tree and Hidden Key. These folks can afford to pay more for insurance PROVIDED someone else will write the policy. No insurance = no loan = reduced sales prices. It will also affect in-fill lots in some locations in the acreage. AND it will affect some new construction but not really in our area as the larger developments are not in the SFHA.

How do I know is there has been any claims made on a property?

First of all, as of January 2019 there are about 66 Repetitive Loss Properties (residential & commercial) in Palm Beach County according to a database called the Comprehensive Loss Underwriting Exchange, or CLUE. Underwriters use the information in a CLUE report to rate insurance policies. Only the Owner and their lender may access the CLUE reports and thus you will have to ask the Owner to provide it to you or sign an authorization for it to be released to you.