September 2024 – Note there is a new version of this released in August 2024 to comply with the NAR Settlement.

The latest version of the contract commonly used to purchase property in the Jupiter area has been release and will be used from 1 November 2021 and a few of the riders were updated as well.

FAR posted this really nice “talking contract” that has links to audio segments for the changes made.

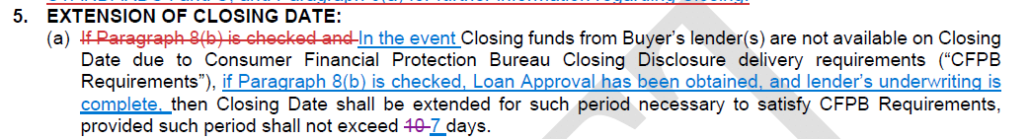

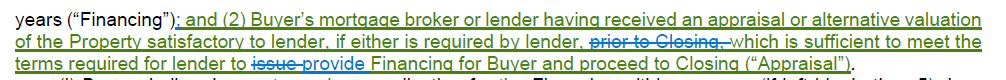

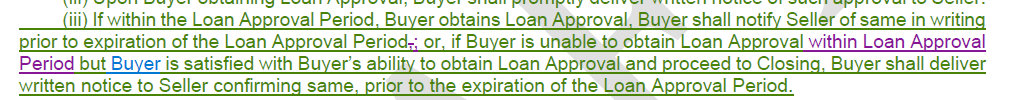

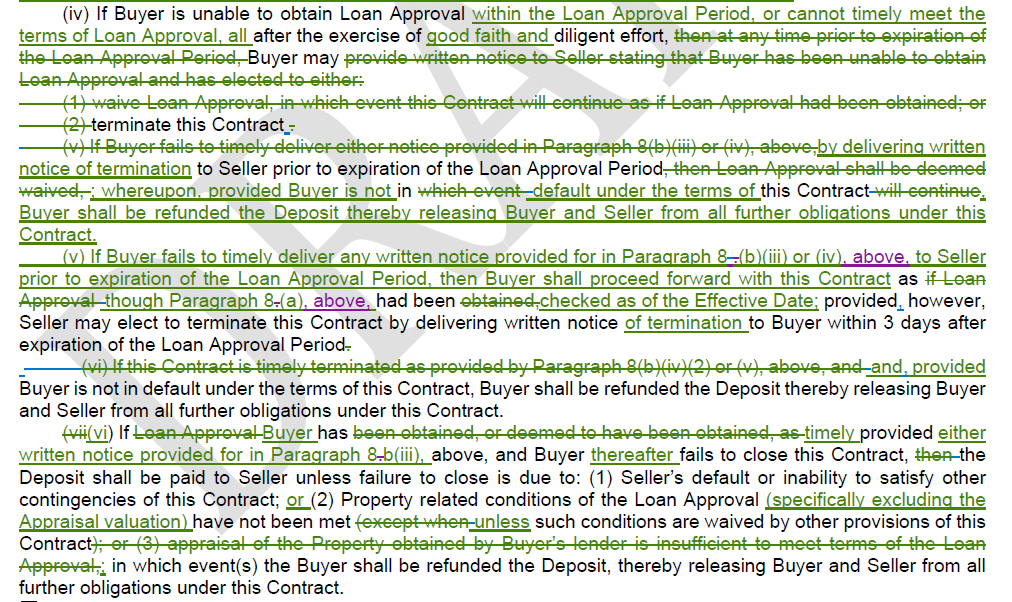

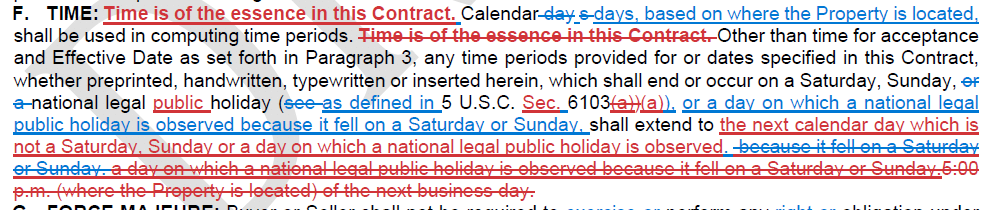

This is a MAJOR revision to the Contract most people use and to the paragraphs that are often spoken of. Things like the appraisal timing, financing deadline an SFPB extensions. My notable changes for everyday sales are:

- New Year’s Day (January 1)

- Martin Luther King Jr. Day (Third Monday in January)

- Presidents’ Day (Third Monday in February)

- Memorial Day (Last Monday in May)

- Juneteenth (June 19)

- Independence Day (July 4)

- Labor Day (First Monday in September)

- Columbus Day (Second Monday in October)

- Veterans Day (November 11)

- Thanksgiving Day (Fourth Thursday of November)

- Christmas Day (December 25)