What’s going on with the new apartments planned for the intersection of US-1 and Yacht Club Drive in North Palm Beach?

The developer is an entity affiliated with the Farmer’s Table restaurant located in the North Palm Beach Country Club. That entity has purchased the 3 lots from the corner of Yacht Club and moving north and is proposing to place on this site 206 units on a little over 4 acres. This proposal has already passed the Planning Commission. This single development will produce 300 or so bedrooms which is about 38% of ALL of the bedrooms in the Yacht Club Addition which it abuts.

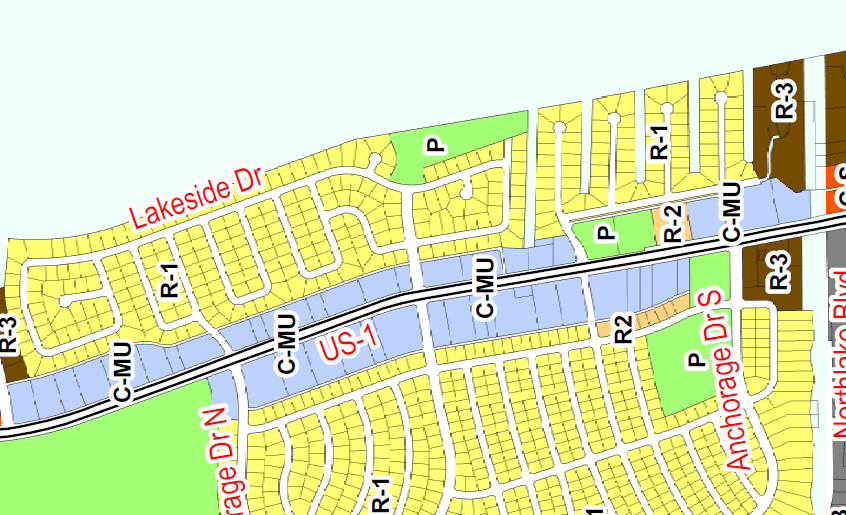

The story begins years ago, 2016 or so, when the Village undertook a Master Plan initiative and devised changes to both the zoning zones and the ordinance for those zones. This sat on the Village web site until late 2021 when the changes were actually enacted. Amongst those changes the commercially zoned land along Rt One, where one could have 12 residential units per acre, to a new C-MU zoning where one could have 24 by right, but 36 if you have workforce housing, and 72 units per acre if you have all 1 bed units.

“General description. This mixed-use district will encourage the redevelopment of the US Highway 1 corridor into a vibrant mixed-use place for businesses, visitors, and residents of North Palm Beach. A Citizens Master Plan, adopted in 2016, envisioned the US Highway 1 corridor evolving into a better working and living environment with walkable and bikeable streets, compact mixed-use buildings, and convenient access to many forms of transportation. The C-MU zoning district is a form-based code that uses clear and predictable standards to guide redevelopment into this pattern.”

“Density. Residential density in the C-MU zoning district may not exceed twenty-four (24) units per acre. The acreage in this formula is the total area enclosed by the lot lines of the site being developed, including existing easements and including any land being dedicated for additional right-of-way or easements. The residential density of a mixed-use development in the C-MU zoning district shall be increased from twenty-four (24) to thirty-six (36) units per acre provided a development is consistent with the workforce housing density bonus granted by Policy 1.B.2 in the Comprehensive Plan.”

But note the definition…

Dwelling unit is a single unit providing complete, independent living facilities for one (1) or more persons including permanent provisions for living, sleeping, eating, cooking and sanitation. For purposes of computing residential density in commercial zoning districts that allow mixed uses, a dwelling unit that contains only one bedroom, or no separate bedroom, will be counted as one-half (