4206 Myrtlewood Circle E, Palm Beach Gardens, FL 33418 is located in the Fiore at the Gardens community.

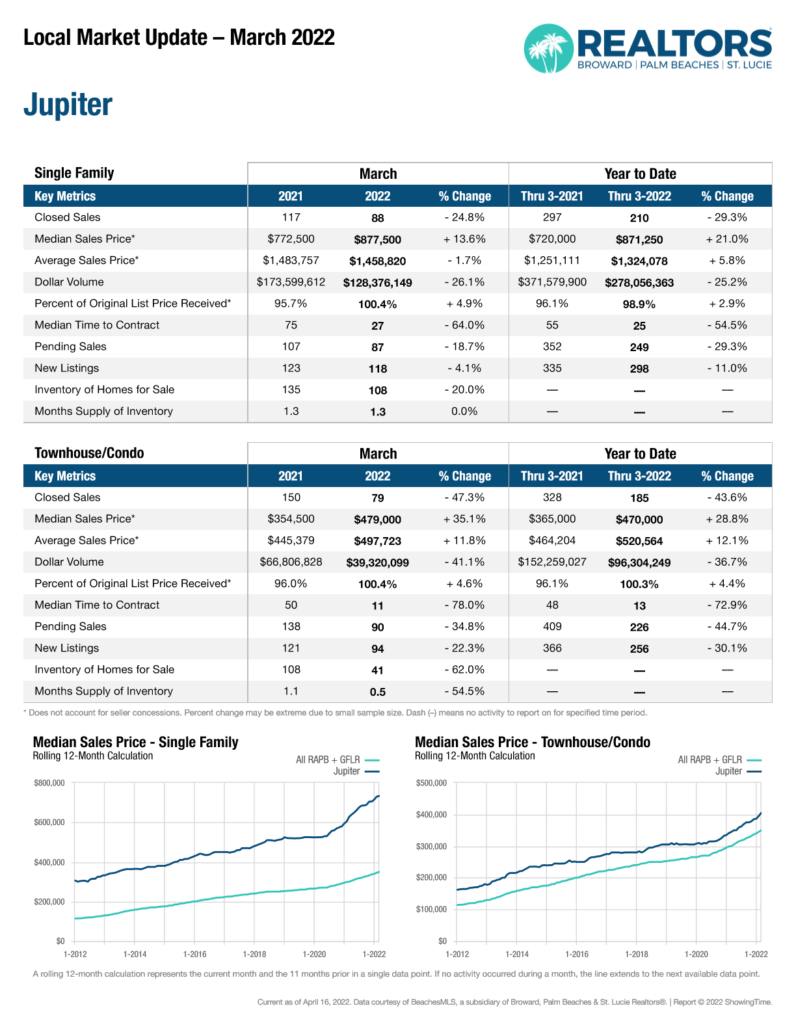

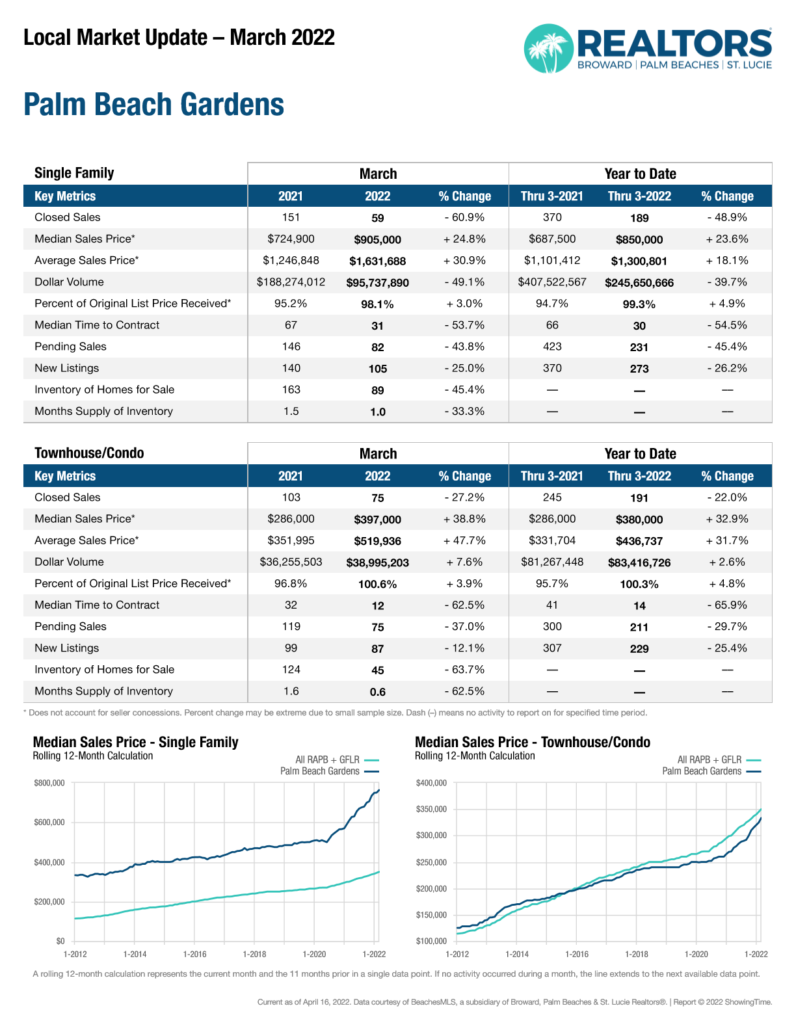

Jupiter and Palm Beach Gardens March 2022 Housing Sales Numbers

Changes in the Market in March…

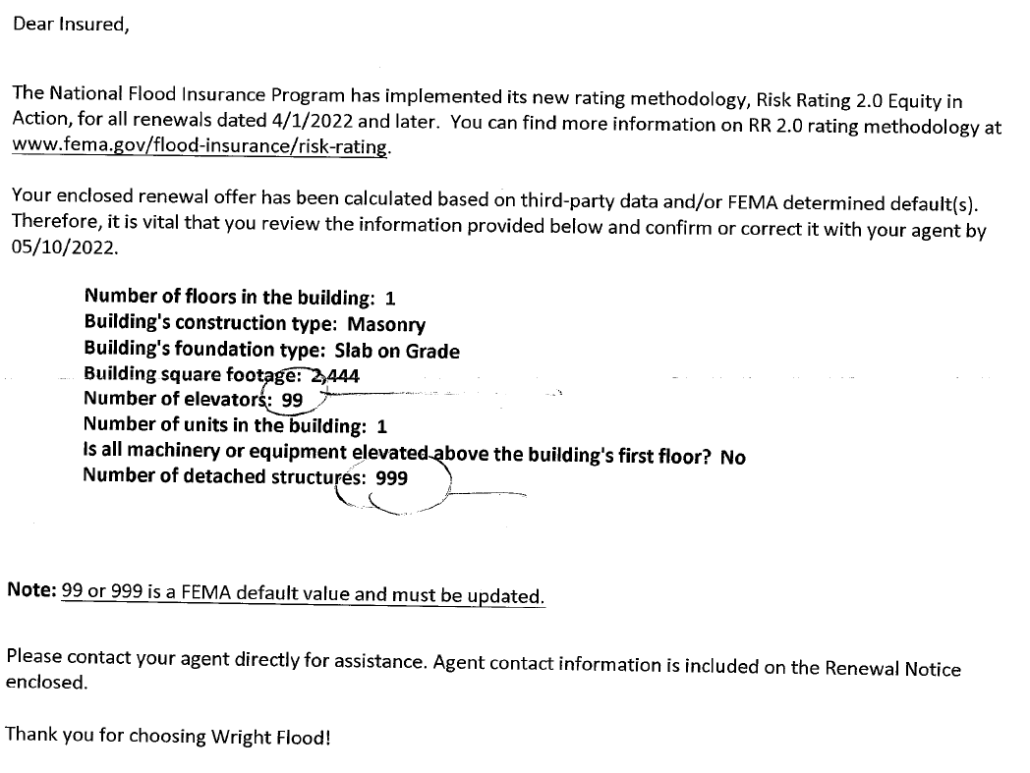

Checking the FEMA Flood Insurance Quote parameters

Some time ago I did this post on making sure one gets the right parameters for your new Risk Rating 2.0 policy. Well, I just got my renewal offer and this is where the rubber meets the road.

This data all looks OK to me for rating purposes but I was expecting to see a Ground Elevation and First Floor Height defined.

Closing of Railroad Bridge over the Jupiter Inlet west of A1A.

March – 2023: Were you looking for information on the closing of the US-1 bridge over the Jupiter Inlet from Tequesta to Jupiter?

Loxahatchee River Navigation Channel Open to Boat Traffic for Two Hours Daily Through Saturday, May 21 2022

| Beginning today, April 11, the navigation channel of the Loxahatchee River will be closed to marine traffic with the exception of two one-hour openings daily. This closure is due to Brightline |

My Buyer submitted a full price offer that was rejected

By Joel Maxson

As this seller’s market continues to run wild throughout Fla., many people are asking what laws or contract terms come into play if a seller rejects a buyer’s offer even though it included all the terms the seller requested.

ORLANDO, Fla. – When a seller markets real property for sale, they typically describe what they’re looking for in an offer. The most common item is a list price, although there can be additional terms, like whether they will accept a financing contingency, and, if so, what type(s). Ultimately, the amount of detail they include is up to them. But what happens when a buyer submits an offer giving them everything they seek, but the seller rejects that offer?

Listing broker

When a seller retains a listing broker to help market their property, they often negotiate a listing agreement. If they enter into a Florida Realtors® Exclusive Right of Sale Listing Agreement, Section 3 (Price and Terms) allows the parties to insert a list price, financing terms, and seller expenses. These terms are more important than many people realize because they tie into Section 8(d). This section provides that “Broker’s fee (commission) is due … if Seller refuses or fails to sign an offer at the price and terms stated in this Agreement.” Therefore, in our scenario where the offer meets all the terms but the seller rejects it, the commission is due. This doesn’t mean the broker is obligated to demand the commission. In most cases, the listing firm will keep marketing the property until the seller finds a different buyer they want to work with. However, if the seller’s rejection of the offer is part of their broader attempt to walk away from the listing agreement, the listing broker is more likely to demand the commission. Either way, per the Florida Realtors form listing agreement, the brokerage firm has completed the task they were hired to do and is entitled to commission.

Buyer

From a buyer’s perspective, they’re entitled to have the offer presented, since the listing licensee must present “all offers and counteroffers in a timely manner, unless a party has previously directed the licensee otherwise in writing.” Fla. Stat. 475.278(2)(e) and (3)(a)(8). Please note that in the event the listing broker has a no brokerage relationship with the seller (as is common in limited service listings, for example), they are not obligated to present the offer. However, once the offer is submitted, it’s completely up to the seller whether to accept, reject, counter, or ignore the offer. In rare cases, there could be an issue with deceptive marketing, although the buyer would need additional facts that show dishonesty – not just a seller change of heart – once offers start rolling in.

Cooperating brokers

A cooperating broker would typically look to an offer of compensation in the multiple listing service for commission. To earn the commission, they need to be the procuring cause of a sale that closes. Since the offer was rejected (not even close to a closed sale), the cooperating broker would not be entitled to the offered compensation. There’s one final agreement to review. Sometimes, a buyer and brokerage firm will enter into a Florida Realtors Exclusive Buyer Broker Agreement. When does a buyer owe commission under that agreement? Section 7 provides that it’s due when “Buyer or any person acting for or on behalf of Buyer contracts to acquire real property as specified in this Agreement.” In this scenario, the offer was rejected, so the buyer’s brokerage firm is not yet entitled to commission under the agreement. Joel Maxson is Associate General Counsel for Florida Realtors Note: Advice deemed accurate on date of publication © 2022 Florida Realtors®

FIRPTA and the Florida FAR BAR As Is V6 (2021)

If you deal with foreign national clients, then you are most likely familiar with FIRPTA.

test

|