430 Mars Way Juno Beach FL 33408

Beach living with no membership & no HOA! Live less than a block from your own private neighborhood beach in the quaint beach town of Juno…this 3 bedroom 2 bath home with bonus room for office/gym/4th bedroom, 2 car garage has a beautiful fenced front and back yard with irrigation system, pool and screened patio. Town of Juno Beach allows building up, so you can easily make it a 3500-4000 sq ft home with 3 car garage. Entire home has brand new hurricane impact glass. Fishing at Juno Pier a short walk and dogs welcome at dog beach nearby as well. Possible lease purchase

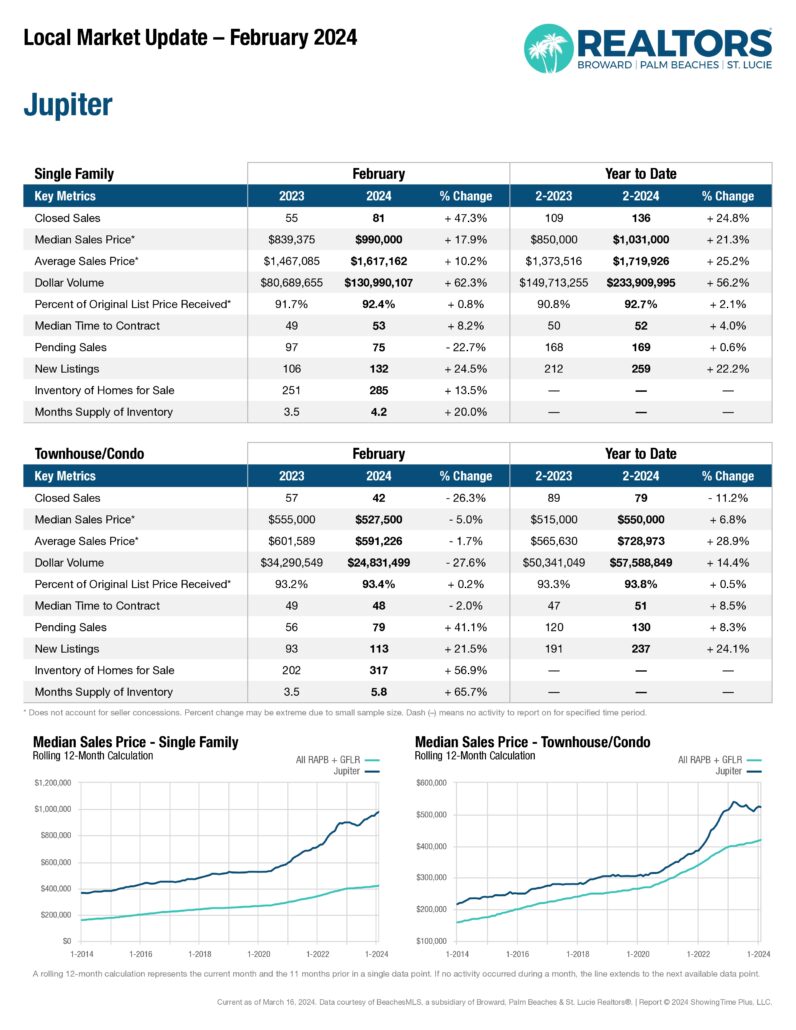

This data is courtesy of: Compass Florida LLC