Sonoma Isles by DiVosta in Jupiter just released the pricing of their units. From

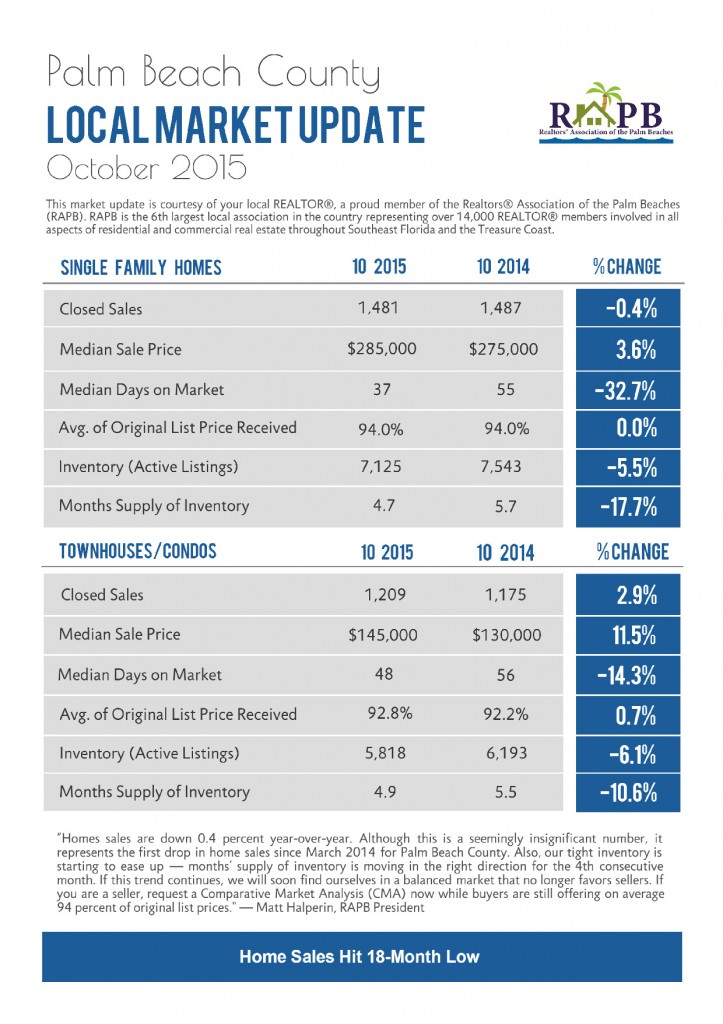

PB County October 2015 Housing Sales

Hot off the presses. The Realtors Association of the Palm Beaches (RAPB) just releases the housing sales numbers for October 2015…

Closed sales of Single family homes are off every so slightly while condo and town home sales are up slightly. In Jupiter closed sales of all products is down 8.4% and in Palm Beach Gardens down 3.3%. So what’s the story? It’s the adage of the old store keeper ‘It’s hard to sell from an empty shelf’. IN the entirety of the Town of Jupiter there are just 651 units for sale, down from 937 a year ago. I posted about the severe lack of inventory in the Bluffs. Between the Ridge and the River at the Bluffs there are 980 detached single family homes and there is just one currently active for sale at 976 Seashore. A similar story in Cypress Point where we have a small condo listed and it the only unit for sale. If a customer wants to be in one the houses at the Bluffs there is just one to go see.

Villas on the Green in Jupiter Unit 202

Tom Howard in our office has a great listing in Villas on the Green in Jupiter. Click on the address below to see the full listing details for this property

717 S US Highway One, Unit 202 Jupiter FL

This unit is now the least expensive unit in the complex and priced 30k below the next unit of the same size. These are well laid out floor plans. The unit is on the first floor for easy access. One can step out the back onto a grass area or continue down through a gate into Carlin Park and onto Jupiter Beach. The Unit has all laminate floors, a new AC and Water Heater. The kitchen and baths could use a face lift but that’s why it’s 30k less than the next listing. There is a stacked washer dryer in the unit as well.

Jupiter Bay Unit A 101 – Jupiter FL

I saw this Jupiter FL unit last week in Jupiter Bay, the condos at the southeast corner of Indiantown Rd and US-1….

353 S US 1 unit A101 Jupiter FL 33477

What I did like about the unit is the lay out. This is one of the 2 story units on the ends of the buildings so first of all an end unit. Like it. A half bath and laundy room on the first floor with both beds and 2 full baths upstairs. The first floor has both a screened patio, facing south in the back looking at the lake as well a side (east facing) patio that’s at grade and not screened. This is a nice spot to keep a bike or beach gear. The unit is basically all origional But I like the location and exposure. As I like to say you can change everything about a unit you don’t like except the location. The second floor guest bedroom has it’s own entrance from the second floor cat walk and the master has a patio that faces the lake which is not screened.

Jupiter Bay allows one small pet under 20#’s and is one of the VERY few communities which allow short term rentals making these very popular with people for investments or for those looking to offset the cost of ownership. Only the C building requires a minimum 30 day rental.

Bottom Line: Nice unit but for this price (329k) you could be in a 3 bed in Bella Vista on the Park

This is a very nice development that abuts Carlin Park so one can walk through the park to the beach and activities held in the park like concerts and plays. There is a pool of course as well as the usual restrictions of no trucks or RV’s. A nice feature is that there is a very nice restaurant right inside the community and the Maltz Jupiter Theatre as well as the new Harbourside Place is across the street.

209 Mainsail Cir in Sea Colony in Jupiter Florida

13 January 2016 update: Very interesting. This place does not show well at all but still an interest sign. The price has been reduced yet again to 249.9k. Again I see units that are priced well but the market is simply not responding.

14 December 2015 update: This property is still sitting there and they just reduced the asking price from 309.9k to a ‘that’s more like it’ asking price of 279.5k. Again, my thoughts on this unit are that it should sell around 260k.

I went to view the new bank owned listing (aka REO) in Sea Colony in Jupiter yesterday at 209 Mainsail. A flurry of activity in there these with all the repairs going on. Sea Colony is a terrific community, gated, a manned gate at that, tennis courts, a nice pool area, on site managers and above all it’s an easy walk to the Jupiter Beach.

So, this place is in tough shape. All original everything, kitchen, baths, flooring etc. The AC needs to be replaced. And after all that the unit has a western exposure view of the parking lot. My saying of ‘everything is worth owning at the right number’ would dictate a sale of this property someplace around 260k. This would allow for renovations of the property and end up around 310-320k. Otherwise one would be better off to look at 706 Mainsail which is fully renovated, east exposure and a FAR better floor plan. A big problem with 209 that can not be fixed is that the 2nd bedroom is a loft right now. So OK but that can be enclosed as it does have a closet. BUT the second bath is upstairs on what is actually the third floor. In both these units one must go up a flight of stairs to the living area. So in unit 209 if one has guests over for dinner they must use the only rest room that is not the master bath which is upstairs. Awkward at best. 706 not only has an east exposure but a view of some green space and an OCEAN view from the master which for that floor plan is on the third floor.

North Palm to Jupiter Boat Parade

The 2019 boat parade from North Palm Beach to Jupiter is coming up on Saturday December 7th 2019. The parade starts just off of Old Port Cove at about 6pm and is scheduled to end just inside the Jupiter Inlet on the back side of Jupiter Island at about, they say, 8pm but it’s always more like 8.30 or even later.

CLICK HERE to go to the official web site for this event.

DON’T look at this image. It’s from last year.

- « Previous Page

- 1

- …

- 127

- 128

- 129

- 130

- 131

- …

- 159

- Next Page »